- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 05/06/25

TPTP 05/06/25

Mike Larson | Editor-in-Chief

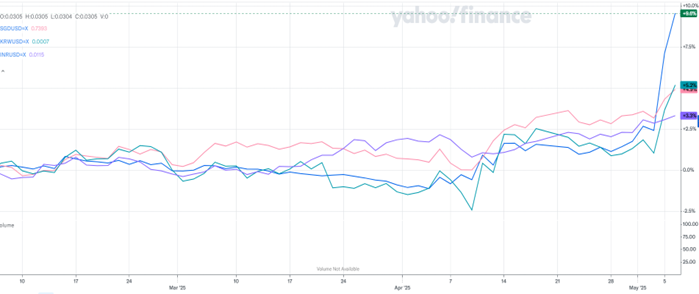

Foreign exchange is where the action is in this market, with the US dollar losing gobs of points against several foreign currencies so far this week. Gold is rallying along with silver in response. Crude oil is up, too, while equities are sliding.

Remember the Asian currency crisis in 1997-1998? Well, this is like that...only IN REVERSE. Currencies across Asia have been surging against the US dollar this week, rather than collapsing as they did in the 90s. The Taiwan Dollar, for one, soared 5% against the US dollar on Monday. That was its biggest rally since the 1980s. The Singapore dollar jumped to its highest level against the greenback in a decade-plus.

Taiwan Dollar, Singapore Dollar, South Korean Won,

Indian Rupee (3-Mo. % Change Vs. USD)

The Trump Administration’s policies are a key driver. Higher proposed and enacted tariffs on Asian nations, plus expectations of weaker US growth, are discouraging global money flows into US assets and the US currency. Investors are also trading on the assumption any trade deals between the US and Asian nations would include “wink-nudge” (or even explicit) global approval of dollar weakening to placate Trump.

Meanwhile, Ford Motor Co. (F) joined the list of companies warning about the impact of Trump’s tariffs on profit. The auto giant said tariffs on imported vehicles and auto parts would slice $1.5 BILLION off earnings before interest and taxes (EBIT) this year. The warning follows one last week from General Motors Co. (GM). GM projected a $4 billion to $5 billion EBIT hit.

Finally, DoorDash Inc. (DASH) is ramping up its global food-delivery business, acquiring Deliveroo for around $3.85 billion. The purchase of a top British rival will boost its European exposure. Deliveroo has approximately 7 million monthly active users, which will join the 42 million on DoorDash’s platform.

S&P 500 5,650.38 (-0.64%) ↓ | VIX 24.67 (+4.36%) ↑ |

Dow Jones Industrial Average 41,218.83 (-0.24%) ↓ | Gold $3,386.20 per ounce (+1.92%) ↑ |

Nasdaq Composite 17,844.24 (-0.74%) ↓ | Oil $58.31 per barrel (+2.07%) ↑ |

Our MoneyShow video vault is chock full of great insights and timeless advice! Here’s an “oldie but goodie” segment from Dan Gramza, President of Gramza Capital Management. See what three things the longtime trading educator advises every trader to do!

Stocks: Good Outweighs Bad, New Highs Ahead!

👉️ TICKERS: DIA, QQQ, SPY

My fiancée Anne and I escaped to France last week for a pre-wedding celebration. Stepping away from the media’s incessant “breaking news” proved refreshing. People get so worked up over headlines. Focus on Time in the Market, not Timing the Market, advises Adam Johnson, editor of Bullseye Brief.

Fed to Stand Pat, Earnings Flood to Continue in Busy Market Week

👉️ TICKER: SPX

The Federal Reserve meets this week. Spoiler alert: Essentially no one thinks a rate cut is likely. Meanwhile, it’s another peak week for corporate earnings. So far, 65% of S&P 500 Index (SPX) companies have reported and earnings are up 13% from the prior-year quarter, notes John Eade, president of Argus Research.