- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 05/05/25

TPTP 05/05/25

Mike Larson | Editor-in-Chief

The S&P 500 just notched nine “up” days in a row, the longest string since 2004. Now, stocks are easing back in early trading. Crude oil and the dollar are cooling, while gold and silver are rallying nicely. Treasuries are a bit lower.

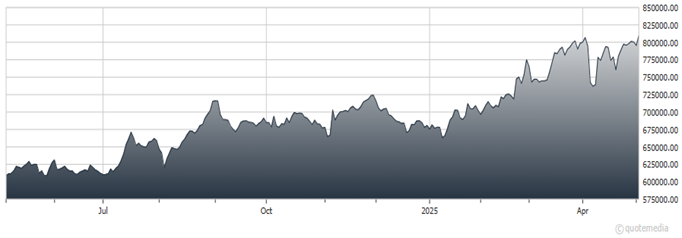

It’s the end of an era at Berkshire Hathaway Inc. (BRK.A). Longtime CEO and legendary investor Warren Buffett announced at his annual shareholder meeting this weekend that he would step down at the end of the year. Greg Abel, the firm’s vice chairman, will assume his role – as first revealed back in 2021. Succession planning was key at the firm given Buffett is 94 years old, and that Buffett's former right-hand-man Charlie Munger passed away in November 2023.

Berkshire Hathaway Inc. (BRK.A)

Yes, I’m going to use the term “Merger Monday.” Don’t judge! Dallas-based Sunoco LP (SUN) said it would buy Parkland Corp. (PKI.CA) for $9.1 billion. The C$44-per-share offer represents a 21% premium to where Parkland closed on Friday.

SUN distributes gasoline to US service stations, while also operating a network of its own fuel-and-convenience stores under the APlus, Stripes, and Tigermarket brands. Calgary-based Parkland does the same throughout Canada, the US, and the Caribbean.

In his latest tariff move, President Trump said he would slap 100% levies on foreign-produced movies. He said having movies produced in other countries relative to the US was a “national security threat,” while also noting that several foreign nations offer financial incentives to lure filmmakers overseas.

An estimated $248 billion will be spent worldwide on content production in 2025, according to Ampere Analysis. Film studios and companies with streaming operations like Netflix Inc. (NFLX), Walt Disney Co. (DIS), and Amazon.com Inc. (AMZN) could face margin pressure if they lose access to foreign production credits and have to re-shore some operations.

S&P 500 5,686.67 (+1.47%) ↑ | VIX 24.54 (+8.2%) ↑ |

Dow Jones Industrial Average 41,317.43 (+1.39%) ↑ | Gold $3,324.50 per ounce (+2.5%) ↑ |

Nasdaq Composite 17,977.73 (+1.51%) ↑ | Oil $57.38 per barrel (-1.56%) ↓ |

Gold just hit an all-time high above $3,500 an ounce. Now, it’s consolidating its big run. What do gold mining CEOs think about the move? And how will shareholders benefit from their NEW approach to doing business? See what Amber Kanwar, host of the In the Money with Amber Kanwar podcast, had to say in this MoneyShow MoneyMasters Podcast excerpt!

Amid Economic Uncertainty, Remember that "Time Pays" for Investors

👉️ TICKER: SPX

We’ve been getting ambiguous signals in the economic data. On one hand, the soft, sentiment-oriented data has been disappointing. On the other hand, the hard data, which reflects actual activity, has been strong. Regardless, remember that in the stock market, time pays, advises Sam Ro, editor of Tker.co.

Why and How to Track Sovereign Wealth Funds Amid Global Power Struggles

👉️ TICKER: SPX

Forget tanks. Forget missiles. The battle for global dominance is being waged with capital — $11 trillion worth of it. That’s the combined war chest of the world’s sovereign wealth funds (SWFs). Here’s what it means for you – the retail investor in the crossfire, writes Nicholas Vardy, editor of The Global Guru.