- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 04/30/25

TPTP 04/30/25

Mike Larson | Editor-in-Chief

Stocks are sliding along with oil in the early going. Gold and silver are down as well, while the dollar and Treasuries are flat.

Hardly a day goes by without more tariff-related headlines – and today is no exception. Overnight, an index that tracks Chinese manufacturing activity sank to 49 in April from 50.5 in March. That was the weakest since December 2023. A sub-index that tracks exports sank to the lowest since December 2022, a sign US tariffs are starting to bite.

Meanwhile, India has been benefiting from China’s woes. The country’s rupee currency just surged to its highest level in 2025 against the US dollar. Plus, foreign inflows into Indian stocks jumped to $975 million in April – a huge swing from prior outflows of more than $3 billion.

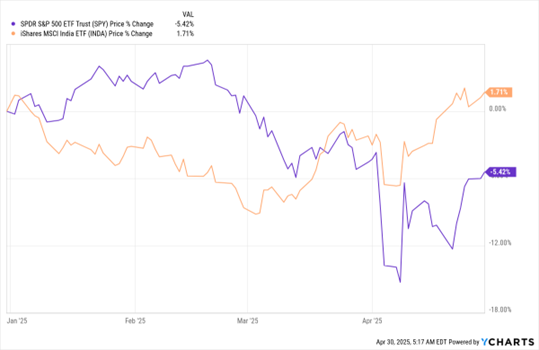

SPY, INDA (YTD % Change)

Data by YCharts

Many observers think India could strike a deal with the US ahead of other countries, not to mention see more demand for its exports as companies shift foreign production to the country. The iShares MSCI India ETF (INDA) was recently up 1.7% year-to-date, compared with a loss of 5.4% for the SPDR S&P 500 ETF (SPY).

In the US, more companies are suspending previous earnings guidance and more CEOs are warning about economic uncertainty caused by shifting trade policy. A business group polled more than 300 senior business executives, and 84% said they were somewhat or very concerned about the political and legal backdrop, according to the Wall Street Journal.

That said, both US Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent have suggested progress is being made on the deal front with some foreign countries. Plus, markets have had a better tone to them recently – with buyers stepping in on pullbacks and the S&P 500 up more than 575 points from its early-April panic lows.

S&P 500 5,560.83 (+0.58%) ↑ | VIX 24.64 (+1.94%) ↑ |

Dow Jones Industrial Average 40,527.62 (+0.75%) ↑ | Gold $3,289.20 per ounce (-1.33%) ↓ |

Nasdaq Composite 17,461.32 (+0.55%) ↑ | Oil $59.89 per barrel (-0.88%) ↓ |

Is “Buy the Dip” going “Missing in Action?” My latest MoneyShow MoneyMasters Podcast guest says she’s seen a change in attitude among the fund managers and other experts she speaks with. See what Amber Kanwar, host of the In the Money with Amber Kanwar podcast, had to say in this excerpt.

Cybersecurity: What a $180 MLN "Vote of Confidence" Says About the Sector

👉️ TICKERS: QQQ, SNOW, WDAY, TEAM

Cybersecurity just got a $180 million vote of confidence. Atlassian Corp. (TEAM), Snowflake Inc. (SNOW), and Workday Inc. (WDAY) backed cybersecurity startup Veza in a fresh $108 million funding round, highlighting how aggressively big cloud companies are doubling down on security, highlights Keith Fitz-Gerald, editor of 5 With Fitz.

NVDA, TSM: Undervalued (Yes, UNDERvalued!) and Primed for a Recovery

👉️ TICKERS: TSM, NVDA

Technology investors are living in a paradox. The paradox is that tech stocks — especially semiconductors — were not overpriced before the Trump Slump and are likely to prove exceptionally resilient. I like Nvidia Corp. (NVDA) and Taiwan Semiconductor Manufacturing Co. (TSM), writes George Gilder, chief analyst at Gilder’s Technology Report.