- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 04/28/25

TPTP 04/28/25

Mike Larson | Editor-in-Chief

Markets are relatively quiet for a change, with stocks, crude oil, gold and silver all flattish. The dollar is stable, but Treasury prices are lower.

Traders are still focused on...trade. The new concern: That store shelves could start looking a little empty soon. US retailers and wholesalers stocked up on imported goods ahead of President Trump’s tariff announcements, but those inventories are getting wound down. At the same time, inbound shipments and cargo sailings from China have plunged up to 60%.

Some orders will be re-routed to other suppliers in countries with lower tariff rates. But the “gumming up” of global supply chains could impact pricing and availability of goods on US store shelves for some time. Low-priced e-commerce company Shein Group Ltd. is already boosting US prices by anywhere from 30% to 377%, per Bloomberg.

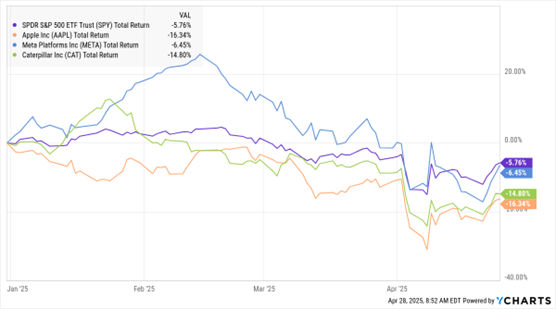

SPY, AAPL, META, CAT (YTD % Return)

From an investor standpoint, what matters most is the pace and details of the trade dealmaking process. Trump Administration policymakers have hinted at deals with countries like Japan and India. But markets will likely need to see concrete progress in the next few weeks if they’re going to resume marching higher.

Meanwhile, we’re getting into the heart of Q1 earnings season this week. Magnificent Seven names like Apple Inc. (AAPL) and Meta Platforms Inc. (META) are set to report results, along with financials like Visa Inc. (V), industrials such as Caterpillar Inc. (CAT), and drug giants Eli Lilly & Co. (LLY) and Amgen Inc. (AMGN).

On the economic front, we’ll get consumer confidence figures on Tuesday...income, spending, and PCE inflation data Wednesday...and the April monthly jobs report on Friday. Those figures come as the 10-year Treasury Note yield is hovering right in the middle of its recent 4%-4.5% trading range.

S&P 500 5,525.21 (+0.74%) ↑ | VIX 25.56 (+2.9%) ↑ |

Dow Jones Industrial Average 40,113.50 (+0.05%) ↑ | Gold $3,307.20 per ounce (+0.27%) ↑ |

Nasdaq Composite 17,382.94 (+1.26%) ↑ | Oil $62.85 per barrel (-0.27%) ↓ |

Is the market upside down — or finally realigning? At the 2025 MoneyShow Masters Symposium Dallas, Jim Bianco, president and macro strategist at Bianco Research, delivered a data-driven, no-nonsense keynote on why the global economic system is at an inflection point. Bianco unveiled his "4-5-6" thesis: A long-term outlook where cash returns 4%, bonds 5%, and stocks just 6% — a far cry from the returns investors have come to expect.

Bitcoin, Crypto, Trading – Get EXPERT Guidance for Greater Profits in Miami!

Looking to mine greater profits from Bitcoin and other cryptocurrencies? Want to level up your trading game? Then book YOUR PASS to the hottest conference this spring – the 2025 MoneyShow Masters Symposium Miami!

From May 15-17 at the Hyatt Regency Miami, you’ll...

* Learn new crypto strategies and investments from experts like Matt Hougan of Bitwise Asset Management and Digital Assets Professional Craig O’Sullivan

* Get trading guidance and coaching during in-depth MoneyMasters Courses like “Three Key Technical Indicators Every Stock Trader Needs” and our “All Stars of Options Panel” session featuring Dr. Alan Ellman and Bruce Marshall

* Mix and mingle with your favorite speakers and fellow attendees during our VIP reception alongside the Miami River downtown

Plus so much more! Click the link below to register for YOUR PASS to all the education and fun in Miami this May…

SPX: Could THIS Signal be the Ultimate Contrarian Indicator?

👉️ TICKERS: VIX, SPX

Last week's The Economist magazine showed an eagle battered by President Trump's first 100 days. We repeat our conclusion from a week prior: Contrarians of the world, unite! Our Roaring 2020s scenario might be back on track soon, observes Ed Yardeni, editor of Yardeni QuickTakes.

GE: Q1 EPS Tops Forecasts, Management Talks Tariff Plans

👉️ TICKER: GE

Last week, GE Aerospace (GE) released Q1 financial results that were given an optimistic reception by investors. While adjusted revenue of $9 billion fell short of the consensus, earnings of $1.49 a share increased 60% from a year ago and beat estimates by 17%, highlights Clif Droke, editor of Cabot Turnaround Letter.