- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 04/22/25

TPTP 04/22/25

Mike Larson | Editor-in-Chief

After yet another pummeling yesterday, stocks are popping in the early going today. Gold topped $3,500 overnight before pulling back, while silver and crude oil are up as well. Treasuries and the dollar are modestly higher.

The bull market in bullion has been a sight to behold! The 2%-plus move overnight pushed gold to another record high, gains driven by money flows into one of the few remaining global “safe havens.” The Trump Administration’s actions on tariffs, trade, and now the Federal Reserve are pushing investors OUT of US assets and IN to foreign markets and gold.

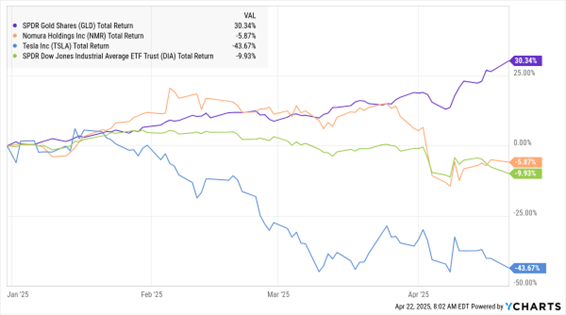

GLD, NMR, TSLA, DIA (YTD % Change)

That said, the “sell US dollar, sell US bonds, sell US stocks, buy gold” move is getting VERY extended – one reason why we’re seeing some retracing of those moves today. And for its part, Nomura Holdings Inc. (NMR) is essentially betting $1.8 billion on a market rebound.

The Japanese financial giant just spent $1.8 billion to buy Macquarie Group Ltd.’s (MQBKY) asset management business unit that covers the US and Europe. It’ll add $180 billion in AUM, with 90% of those assets in the US. The deal is Nomura’s largest since 2008, when it bought assets from Lehman Brothers as that firm failed.

On the earnings front, all eyes will be on Tesla Inc. (TSLA) after the bell. Shares of the Electric Vehicle (EV) maker surged after the election, then tanked as sales slumped. Q1 deliveries were the weakest since Q2 2022.

Shares of other companies like consumer products giant Kimberly-Clark Corp. (KMB) and defense contractor Northrop Grumman Corp. (NOC) are slipping after their numbers came in light. Lockheed Martin Corp. (LMT) bucked the trend, with its stock popping after the defense giant delivered on the profit front in Q1 and reaffirmed its full-year forecast.

S&P 500 5,158.20 (-2.36%) ↓ | VIX 32.46 (-4.02%) ↓ |

Dow Jones Industrial Average 38,170.41 (-2.48%) ↓ | Gold $3,469.30 per ounce (+1.28%) ↑ |

Nasdaq Composite 15,870.90 (-2.55%) ↓ | Oil $64 per barrel (+1.46%) ↑ |

When market chaos strikes, how can traders cope? I covered that topic in detail with trading experts Bruce and Tammy Marshall recently. The husband-and-wife team work for Simpler Trading and ElliottWaveTrader respectively, and they shared their top tips for navigating volatile markets like this one. Check out what they had to say HERE in our MoneyShow MoneyMasters Podcast episode.

Gold: It's Not ONE Thing Driving it. It's EVERY Thing

👉️ TICKER: GLD

Gold surged another $100 at one point yesterday, and even I’m stunned by this rally. This run in gold, now to over $3,400 on a spot basis, has been so remarkable that even the major media are, well...remarking on it, notes Brien Lundin, executive editor of Gold Newsletter.

SKYE: A Speculative Play in the Weight Loss Drug Space

👉️ TICKER: SKYE

Skye Bioscience Inc. (SKYE) provided new preclinical data using the proprietary human CB1 knock-in diet-induced obesity (DIO) mice model, showing higher-dose nimacimab could achieve a similar degree of weight loss compared to monlunabant and tirzepatide alone, writes John McCamant, editor of Medical Technology Stock Letter.