- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 04/15/25

TPTP 04/15/25

Mike Larson | Editor-in-Chief

Stocks and Treasuries are slipping in the early going, while gold and silver are on the move higher again. Crude oil is down, while the Dollar Index is stabilizing after losing 6% year-to-date. That puts the DXY on track for its worst year since 2017.

Bank of America Corp. (BAC) joined other large financial firms in A) Beating earnings expectations but B) Warning of potential trouble ahead due to rising market and economic volatility. Q1 profit climbed 11% to $7.4 billion. Still, the bank’s provision against future credit losses came in at $1.48 billion, up 12% year-over-year.

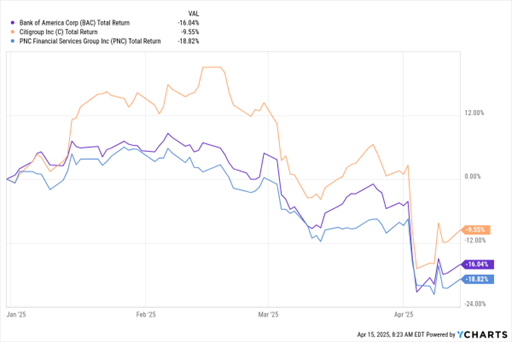

For its part, Citigroup Inc. (C) beat forecasts with a profit of $4.1 billion, or $1.96 per share. Revenue in its markets division jumped 12% as equity, fixed-income, and currency trading activity climbed. Super-regional bank PNC Financial Services Group Inc. (PNC) also benefitted from a sharp rise in capital markets and advisory revenue. But as the chart below shows, all three stocks have had a rough go of things so far in 2025.

BAC, C, PNC (YTD % Change)

While the day-by-day escalation of tariff rates has stopped, both China and the US continue to take other steps in their ongoing trade war. The latest: China’s government ordered its airlines not to take delivery of any more Boeing Co. (BA) airplanes or airplane parts. China used to be a larger Boeing customer, though it has been switching over to Airbus and domestic Comac jets the last few years. But the move still caused BA shares to slip in early trading.

Finally, it’s not just individual investors focusing on doom and gloom. Institutional investors are wildly bearish, too. The latest Bank of America fund manager survey found 82% of those questioned think the US economy will weaken – the most in three decades. On net, 36% are underweighting US stocks, the most ever. Whether gloomy sentiment proves to be a contrary indicator for markets remains to be seen, though.

S&P 500 5,405.97 (+0.79%) ↑ | VIX 30.98 (+0.29%) ↑ |

Dow Jones Industrial Average 40,524.79 (+0.78%) ↑ | Gold $3,233.80 per ounce (+0.23%) ↑ |

Nasdaq Composite 16,831.48 (+0.64%) ↑ | Oil $61.08 per barrel (-0.73%) ↓ |

Global markets are reacting to ongoing tariff disputes, persistent inflation, and shifting energy policies. These forces are driving volatility and creating unique trading opportunities.

In this briefing from Shawn Edwards, VP of institutional ETF sales at Direxion, you’ll get an in-depth look at how these economic dynamics are influencing short-term stock market movements — and how savvy traders can capitalize on these trends using leveraged and inverse ETFs.

SPX: Seller Exhaustion, Green Shoots, & What Sectors to Watch

👉️ TICKER: SPX

At the close of trading on April 8, many of the US equity market benchmarks posted their steepest declines during this nearly two-month long selloff. The S&P 500 was deep in correction territory, off nearly 19%. Even though more is needed for an all-clear market condition, green shoots have begun to appear, advises Sam Stovall, chief investment strategist at CFRA Research.

GBX: A Railcar Supplier Whose Shares are Too Cheap to Pass Up

👉️ TICKER: GBX

Shares of Greenbrier Cos. (GBX) slid more than 10% last week, despite continued margin strength and resilient execution in fiscal Q2. Barring a severe economic downturn, which we foresee as unlikely at present, the nearly 40% drawdown in price since late January brings shares back into accumulation territory, counsels John Buckingham, editor of The Prudent Speculator.