- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 04/14/25

TPTP 04/14/25

Mike Larson | Editor-in-Chief

World equity markets clawed their way back from the brink overnight and this morning, as did crude oil. Treasuries are flat, while gold and silver are mixed – but the US dollar is still trading lower.

That sound you heard this weekend? It was all of “Big Tech-Land” breathing a sigh of relief. The Trump Administration excluded several types of electronics products, from smartphones to memory chips to laptops, from the worst China-focused tariffs late Friday.

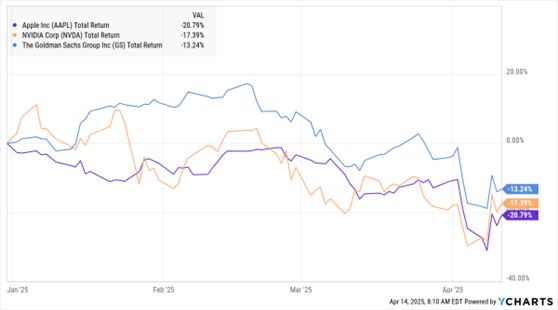

AAPL, NVDA, GS (YTD % Change)

Companies from Apple Inc. (AAPL) to Nvidia Corp. (NVDA) are heavily reliant on manufacturing facilities in China and elsewhere in Asia. The move will give them some temporary relief from Trump’s 125% reciprocal tariffs on China and 10% baseline global tariffs. Still, the president and his economic lieutenants made clear over the weekend that electronics products will face separate tariffs (similar to those focused on industries like steel and autos).

More “Big Finance” names are reporting earnings, including Goldman Sachs Group Inc. (GS) this morning. The Wall Street firm’s profits climbed 15% to $4.74 billion, with the per-share figure of $14.12 crushing estimates of $12.33. That said, increased market volatility is derailing and/or postponing Initial Public Offering (IPO), M&A, and bond underwriting activity – something that could weigh on earnings moving forward. CEO David Solomon alluded to that by saying “we are entering the second quarter with a markedly different operating environment.”

Finally, investors will get a flood of economic data this week. That includes export and import prices tomorrow, retail sales and industrial production on Wednesday, and housing starts on Thursday. These “hard data” reports are for March, so they likely won’t capture the full impact of tariff policy changes. But over the next few weeks, we’ll get more data that either confirms or refutes the negative turn we’ve seen in “soft data” reports on consumer and business confidence.

S&P 500 5,363.36 (+1.81%) ↑ | VIX 33.25 (-11.47%) ↓ |

Dow Jones Industrial Average 40,212.71 (+1.56%) ↑ | Gold $3,242.40 per ounce (-0.07%) ↓ |

Nasdaq Composite 16,724.46 (+2.06%) ↑ | Oil $62.39 per barrel (+1.45%) ↑ |

Charles Payne, host of Fox Business’ Making Money with Charles Payne, sits down with longtime market strategist Keith Fitz-Gerald for a candid and timely conversation about investing in today's volatile environment. Keith reveals why 85% of sell decisions are flat-out wrong—and why now might be one of those times when buying, not selling, could be the smarter move.

They also unpack the psychology behind poor market timing, how retail investors are finally gaining an edge over Wall Street, and why some of the biggest winners could be right under your nose. Check out the segment recently recorded from the floor of our 2025 MoneyShow Masters Symposium Dallas HERE.

Inflation: Where to Find Tariff Impacts in PPI, CPI Reports

👉️ TICKERS: SPY, TLT

The March Producer Price Index unexpectedly fell 0.4% on the headline, versus the estimate for a rise of 0.2% (after a one-tenth gain in February, which was revised up by one tenth). But core goods prices, in light of tariffs, are now the key figure to watch, explains Peter Boockvar, editor of The Boock Report.

Stocks and Bonds: Neither Very Happy Thanks to "TTT"

👉️ TICKERS: SPY, TLT

Last Thursday was not a happy day in the bond market. Neither was it a happy day in the stock market. Why? Trump Tariff Turmoil (TTT) hasn't been significantly reduced by the president’s 90-day postponement of reciprocal tariffs, writes Ed Yardeni, editor of Yardeni QuickTakes.