- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 04/08/25

TPTP 04/08/25

Mike Larson | Editor-in-Chief

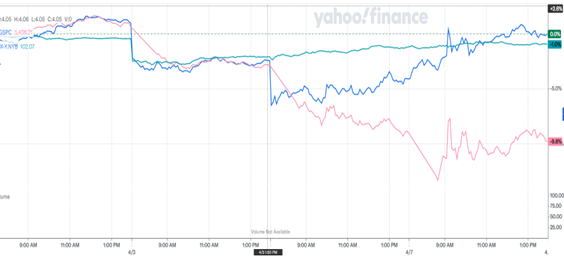

Yesterday’s trading session was one for the record books – and things don’t look to be calming down today, either. In fact, stocks are soaring in the early going along with gold and silver. Treasuries and the dollar are modestly lower after...you guessed it...wild swings on Monday.

Remember how I said a Trump 2.0 administration would mean more two-way VOLATILITY? Well, we had that in spades yesterday. The Dow Jones Industrial Average swung a record 2,595 points from low to high during Monday’s session – with an opening plunge followed by a miraculous surge on a fake headline, which was then given up again.

In dollars-and-cents terms, the “fake news” headline of a 90-day pause in ex-China tariffs added $2.4 TRILLION in value to US equities. Then it evaporated.

S&P 500, 10-Year Yield, Dollar Index (5-Day % Change)

The volatility wasn’t confined to stocks, either. As MoneyShow contributor Jim Bianco of Bianco Research noted on X, the 10-year Treasury Note yield entered the day down 12 basis points from Friday’s close…then finished the day UP 19 bps. That was only the third time in more than a quarter-century of tracking that bond yields have moved like that. Volatility in the foreign exchange market, as tracked by a JPMorgan Chase & Co. index, is also at a two-year high.

While President Trump has so far stood firm on tariffs, his support is starting to give way. Business and Wall Street leaders are increasingly castigating him for his approach, with billionaire Bill Ackman warning they could fuel an “economic nuclear winter” and Ken Griffin, the world’s 31st richest man, describing them as a “huge policy mistake.” Even mega-supporter Elon Musk, the CEO of Tesla Inc. (TSLA), reportedly asked Trump to reverse his latest levies.

That said, Japanese stocks surged overnight on news that Trump’s economic team will soon negotiate with the country over its levies. A visit with Israeli Prime Minister Benjamin Netanyahu yesterday – which included friendly commentary on US-Israeli trade and relations – also helped lighten Wall Street’s mood (a bit).

S&P 500 5,062.25 (-0.23%) ↓ | VIX 40.74 (-13.28%) ↓ |

Dow Jones Industrial Average 37,965.60 (-0.91%) ↓ | Gold $3,020 per ounce (+1.56%) ↑ |

Nasdaq Composite 15,603.26 (+0.1%) ↑ | Oil $61.03 per barrel (+0.54%) ↑ |

The markets have been on a wild ride lately, and it’s not slowing down anytime soon. So, I’ve been reaching out to our top MoneyShow experts to get their take on what’s going on — and what to do about. In this special video update, check out three of their top tips for negotiating the chaos.

Markets: How Much More Will the Averages, Bank Stocks Sink?

There is a gob of Play-Doh newly enmeshed into my bedroom carpet. Normally this would set-off a material increase in tempers while I mentally calculate how much this is going to cost me. But it could be worse. It’s not like they made a $6 trillion mess for someone else to clean up, observes Amber Kanwar, host of the In the Money with Amber Kanwar podcast.

Utilities: How Trump Tariffs Could Impact this Defensive Sector

👉️ TICKER: XLU

Let’s start with a clear-eyed look at how the Trump Administration’s trade war is likely to affect the utility sector. Worth highlighting: Though far reaching, these tariffs are only one factor that will affect investment returns going forward, writes Roger Conrad, editor of Conrad’s Utility Investor.