- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 03/31/25

TPTP 03/31/25

Mike Larson | Editor-in-Chief

Stop me if you’ve heard this one: Global stocks are tumbling on tariff talk. After declines of 2% for the S&P 500 and 2.7% for the Nasdaq on Friday, markets are losing another percentage point or so in the early going today. Gold keeps rallying, though, hitting another record high around $3,160 an ounce. Silver and crude oil are up a bit along with Treasuries, while the dollar is flat.

Groundhog Day may be in the rearview mirror. But just like the 1993 Bill Murray movie named after that holiday, markets keep re-living the same lousy day – selling off on President Trump’s tariff plans. Over the weekend, the president said reciprocal tariffs would “start with all countries” on April 2, rather than focus on just a handful of the worst trade-policy offenders. A separate Wall Street Journal story suggested Trump is pushing advisors to be more aggressive, and implement a “big and simple” plan.

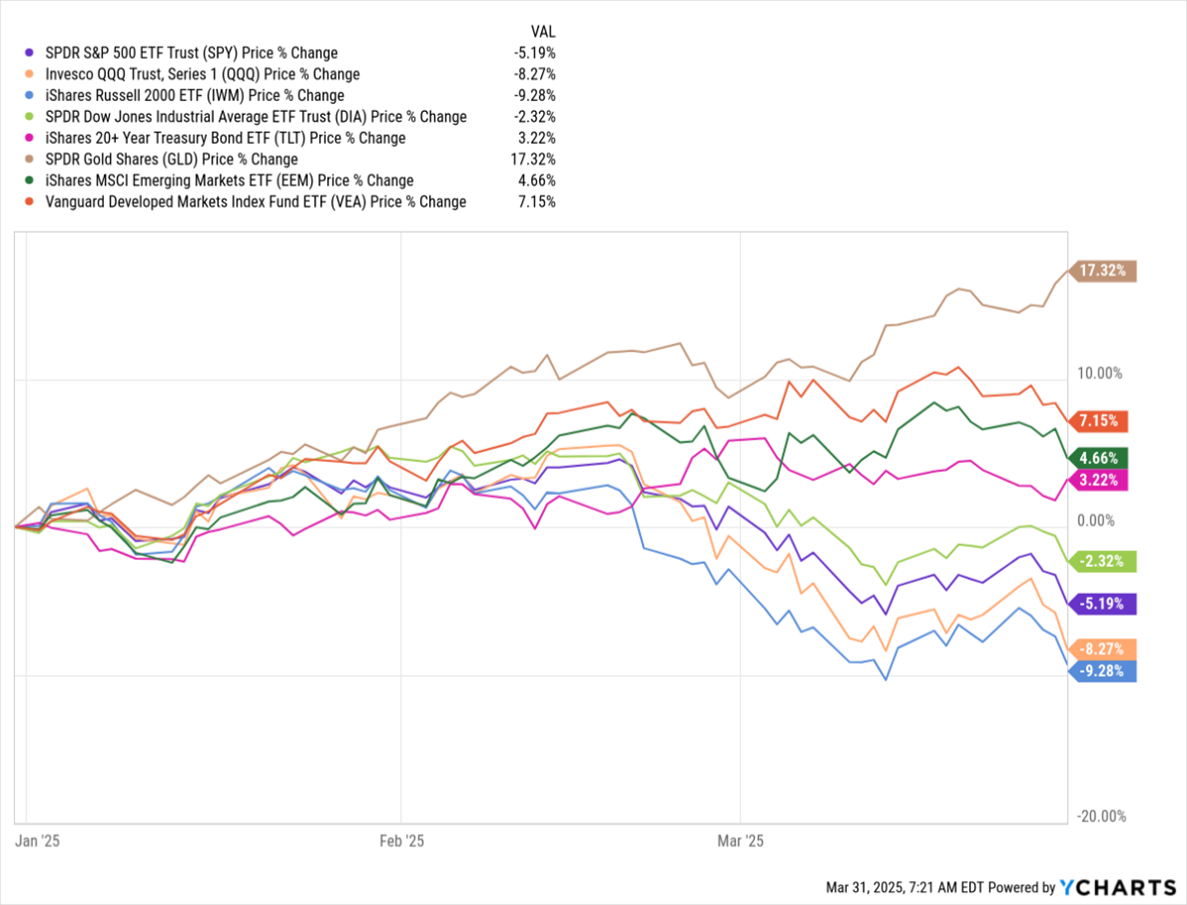

Gold, Treasuries Lead...Small Caps, Tech Lag in Q1?

With April 2 fast approaching, investors are scrambling around the world. Japan’s benchmark index plunged 4% overnight, and the S&P 500 is on track for its worst quarterly performance since 2022. US stocks have shed about $5 TRILLION in value since late February. In Q1, they have also vastly underperformed developed and emerging foreign markets and, of course, gold.

Despite the market gloom, we’re still seeing the occasional M&A deal. Rocket Cos. (RKT) said it would buy Mr. Cooper Group Inc. (COOP) for $9.4 billion to bolster its mortgage-lending operations. The acquisition comes not long after Rocket said it would buy the real estate listings firm Redfin. Mortgage rates have been sliding lately amid reduced inflation and growth expectations. As a result, refinance loan applications are up more than 63% year-over-year.

S&P 500 5,580.94 (-1.97%) ↓ | VIX 24.22 (+11.87%) ↑ |

Dow Jones Industrial Average 41,583.90 (-1.69%) ↓ | Gold $3,155.50 per ounce (+1.32%) ↑ |

Nasdaq Composite 17,322.99 (-2.7%) ↓ | Oil $69.62 per barrel (+0.37%) ↑ |

What can using Anchored VWAP due for you as a trader? Brian Shannon is a veteran trader and founder of Alphatrends.net — and in this MoneyShow MoneyMasters Podcast excerpt, he lays out the case for adding it to your arsenal of trading tools. Check it out HERE!

AI Stocks: What's Next After Microsoft's Data Center News?

👉️ TICKERS: XMAG, MSFT

Microsoft Corp. (MSFT) CEO Satya Nadella said recently, “All I know is, I'm good for my $80 billion” regarding the $500 billion Stargate AI announcement. But a February note from TD Cowen analysts stated that Microsoft was backing out of data center leases. Here’s why AI stock investors shouldn’t be too concerned, writes Ed Yardeni, editor of Yardeni QuickTakes.

MGIC: A Promising Israeli Tech Play to Buy Ahead of Its Matrix Deal

👉️ TICKER: MGIC

Magic Software Enterprises Ltd. (MGIC) isn’t a household name even in the tech world — but that’s never been the point. For over three decades, this Israel-based company has quietly played a pivotal role in enterprise digital transformation, notes George Gilder, editor of Gilder’s Technology Report.

Are you Bullish or Bearish on Stocks? |