- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 03/28/25

TPTP 03/28/25

Mike Larson | Editor-in-Chief

Stocks slid again yesterday amid ongoing tariff turmoil – and they’re modestly weaker this morning, too. Gold and silver are continuing to rally strongly, while crude oil and the dollar are flattish. Treasuries are higher.

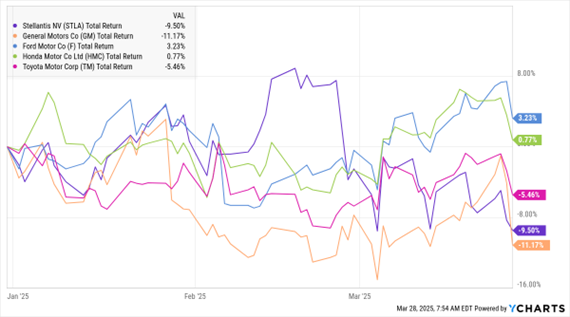

Automaker stocks spiraled lower yesterday after President Trump pulled the trigger on his auto sector tariffs. He slapped 25% tariffs on non-US-produced finished cars, trucks, and auto parts, effective April 2. Curiously, before taking a step that will drive up their costs notably, he reportedly threatened manufacturers NOT to raise prices on their finished products.

The response from one automaker executive, according to the Wall Street Journal? “The math would tell you, that’s going to cost us multibillions of dollars...so who pays for that?” Ferrari NV (RACE) already provided its answer: The high-performance luxury car maker said it would hike prices 10% on several of its models, starting April 1, due to the tariffs.

STLA, GM, F, HMC, TM (YTD % Change)

I wrote this week about how retail stocks are suffering, partly because of tariff worries and partly because of slumping confidence. Yesterday, athletic clothing maker Lululemon Athletica Inc. (LULU) joined the parade of companies saying the macro environment is hurting its results. The stock is falling sharply in early trading.

Government data added a bit to the gloom this morning, too. Personal spending rose a smaller-than-expected 0.4% in February…while the core Personal Consumption Expenditures Index (inflation) rose a greater-than-expected 0.4%. Not great, Bob, as the saying from Mad Men goes.

S&P 500 5,693.31 (-0.33%) ↓ | VIX 19.33 (+3.42%) ↑ |

Dow Jones Industrial Average 42,299.70 (-0.37%) ↓ | Gold $3,117 per ounce (+0.84%) ↑ |

Nasdaq Composite 17,804.03 (-0.53) ↓ | Oil $69.99 per barrel (+0.1%) ↑ |

Welcome to Tariff-Land! It’s not on any map at Disney World…but it’s where investors and traders find themselves regardless. How can you navigate this environment? What do new tariffs mean for stocks? And which asset class is getting turbocharged by the trade war? Find out in my special video update HERE.

Auto Tariffs: What Economic Fallout to Expect in the Months Ahead

👉️ TICKER: KMX

It seems like we're about to learn where that fine line is between encouraging more auto production (both finished product and parts) to come back to the US — and still making cars/trucks that Americans can afford to buy. You need the latter in order to make the former viable, advises Peter Boockvar, editor of The Boock Report.

Copper: Why the "Red Metal" Might be the Next Big Profit Play

👉️ TICKER: CPER

Most investors chase AI, semiconductors, and the latest crypto buzz. But one of the most explosive trades of the year is hiding in plain sight. That trade? Copper, writes Nicholas Vardy, editor of The Global Guru.

Are you Bullish or Bearish on Stocks? |