- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 03/24/25

TPTP 03/24/25

Mike Larson | Editor-in-Chief

Stocks are ripping higher in the early going, while gold, silver, and crude oil are showing more muted advances. Treasuries are sliding, while the dollar is flat. Most major cryptocurrencies, including Bitcoin, are up a couple of percentage points.

Is President Trump walking back his tough tariff talk? That’s what Wall Street seems to think. Stocks are melting up on news the administration might dial back or postpone certain reciprocal or sectoral tariffs past early April. Media reports suggest tariffs will mostly apply to a “dirty 15” group of nations with the largest trade surpluses with the US, and that some “new” tariffs will take into account old tariffs that have already been implemented.

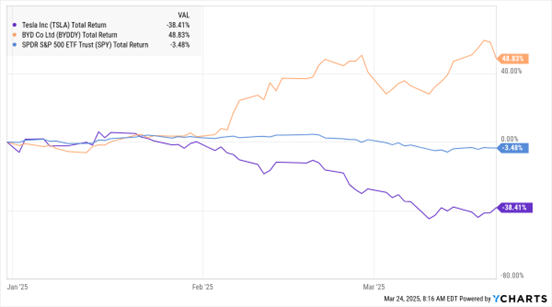

Still, wide-ranging duties will be outlined on April 2. Investors will closely watch to see who will get charged what...and when those charges will take effect. That, in turn, could temper the rebound from the S&P 500’s recent 10% correction. The SPDR S&P 500 ETF (SPY) remains off 3.4% year-to-date.

SPY, TSLA, BYDDY (YTD % Change)

Tesla Inc. (TSLA) shares have come under severe pressure, dropping 38% in 2025, thanks to Cybertruck recalls, sales declines in some countries, and politically inspired protests and boycotts. But shares of one of its main global competitors in the Electric Vehicle (EV) space – BYD Co. Ltd. (BYDDY) – have been on fire, up 48% YTD.

The Chinese company just reported 2024 sales of 777 billion yuan and profit of 40.3 billion yuan. Both readings topped forecasts. Meanwhile, sales in the first two months of 2025 are up 93% from 2024. BYD plans to sell between 5 million and 6 million EVs and hybrids this year.

Lastly, former high-flyer 23andMe Holding Co. (ME) filed for bankruptcy protection yesterday. Investors and users flocked to DNA testing firms like 23andMe and Ancestry DNA several years ago, driving their valuations through the roof. But data breaches and waning popularity sapped revenue, and the companies fell on hard times. ME co-founder and CEO Anne Wojcicki resigned, and its shares plunged another 44% in early trading today.

S&P 500 5,746.60 (+1.39%) ↑ | VIX 18.98 (-1.56%) ↓ |

Dow Jones Industrial Average 42,462.72 (+1.14%) ↑ | Gold $3,030.20 per ounce (+0.29%) ↑ |

Nasdaq Composite 18,060.21 (+1.55%) ↑ | Oil $68.46 per barrel (+0.26%) ↑ |

Restaurant operators have been forced to juggle multiple disconnected systems—until now. SRVE POS and Restaurant Systems Pro are revolutionizing the industry by merging POS, full-service accounting, and operational management into one seamless platform, creating a game-changing investment opportunity. Learn more in this presentation from CEO Fred Langley.

Markets: Why I "Cheer the Bull, Cheer the Bear"

👉️ TICKERS: DIA, QQQ, SPXI recently saw an amazing post from Dinesh, one of the members of my Compounding Quality community, about how to handle the current market volatility. It helps show why declining markets create opportunities, explains Pieter Slegers, editor of Compounding Quality.

SPX: Under Pressure Because of THIS Currency Market Trend

👉️ TICKERS: FXY, SPXOne of my more successful warnings to investors and subscribers over the past couple years has been the reverse yen carry trade. Now, it’s happening again – and impacting the S&P 500 (SPX), writes Michael Gayed, editor of The Lead-Lag Report.

Are you Bullish or Bearish on Stocks? |