- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 03/19/25

TPTP 03/19/25

Mike Larson | Editor-in-Chief

It’s Fed Day everyone! No, it’s not a national holiday…so make sure you show up to work as usual. But definitely keep an eye on Washington around 2 pm Eastern when the Federal Reserve announces the results of its latest gathering. Chairman Jay Powell & Co. won’t cut rates today. But what policymakers say about economic growth and inflation in their post-meeting statement, and what Powell says at his press conference, could move markets notably.

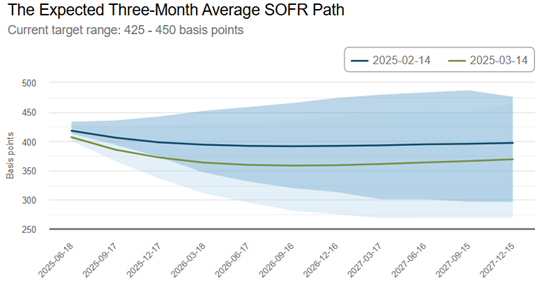

Ahead of the meeting, here’s a chart showing how expectations for the level of the Secured Overnight Financing Rate (SOFR) have changed over time. SOFR is a benchmark short-term rate that financial instruments like derivatives, loans, and other products are priced off of – and it tracks the federal funds rate set by the Fed extremely closely.

Source: Atlanta Fed

What should jump out at you right away? Expectations for the future level of interest rates have DROPPED notably in the last month. That’s shown by the lower level of the green line (expectation as of 3/14/25) relative to the blue line (expectations as of 2/14/25). That reflects worries that tariffs, uncertainty, and declining consumer confidence could lead to slower growth – which the Fed would react to by cutting rates.

Meanwhile, the highly anticipated phone call between President Trump and Russian President Vladimir Putin didn’t result in much concrete progress. The US touted a Russian promise to temporarily avoid striking energy and infrastructure assets, and hold future discussions on a full ceasefire. But Putin wouldn’t agree to Trump’s request for a broader 30-day halt to the war.

Then less than 24 hours later, both Russia and Ukraine accused each other of violating the ceasefire terms amid a hail of drone and missile attacks and counterattacks. Crude oil bounced back after giving up some ground following the call, while gold rallied further on the news of fresh attacks.

S&P 500 5,614.66 (-1.07%) ↓ | VIX 21.62 (-0.37%) ↓ |

Dow Jones Industrial Average 41,581.31 (-0.62%) ↓ | Gold $3,045.90 per ounce (+0.17%) ↑ |

Nasdaq Composite 17,504.12 (-1.71%) ↓ | Oil $66.84 per barrel (-0.09%) ↓ |

As the 2025 markets ebb and flow, NNN REIT, Inc. (NNN) remains well-positioned to react to any elevated economic and capital market challenges that may arise. For 40 years, NNN has applied a multi-year view to operating the company, focusing on producing consistent per-share results. Find out more about its approach in this briefing from Chris Barry, VP, corporate communications and investor relations at NNN.

Gold $3K Target Hit! Now, Look for Miners to Do THIS

👉️ TICKERS: GDXJ, GLD

It’s been a remarkable run to the historic $3,000 level in gold...but it hasn’t been quite as carefree as the charts might show. It’s often said that “A bull market climbs a wall of worry” but this gold bull has seemingly climbed a “cliff of concern” amongst oft-beaten gold investors. Now, start your due diligence on the best of the junior mining stocks, advises Brien Lundin, executive editor of Gold Newsletter.

PEP: What the $1.9 BLN Poppi Buy Says About the Beverage Market

👉️ TICKERS: KO, PEP

Multinational food and beverage companies aren’t typically the lead story in markets because, quite frankly, they’re usually boring. Slow growth, boring business. But every now and again, we have an opportunity to talk about them. Today’s subject is PepsiCo Inc. (PEP), notes Tom Bruni, editor-in-chief of The Daily Rip by Stocktwits.

Are you Bullish or Bearish on Stocks? |