- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 03/17/25

TPTP 03/17/25

Mike Larson | Editor-in-Chief

Happy St. Patrick’s Day! Stocks are mixed in the early going, though investors are hoping we’ll see some green later after a strong rally Friday. Gold, silver, Treasuries, and the dollar are mostly flat, while oil is up a bit.

Investors are dealing with two issues today. First, Treasury Secretary Scott Bessent characterized the recent slump as a “healthy” correction over the weekend, adding that he is “not worried about the markets.” That suggests there is no “Trump Put” under stocks. The S&P 500 is down just over 9% from its February high, but many high-momentum, widely held stocks and cryptocurrencies are down much more.

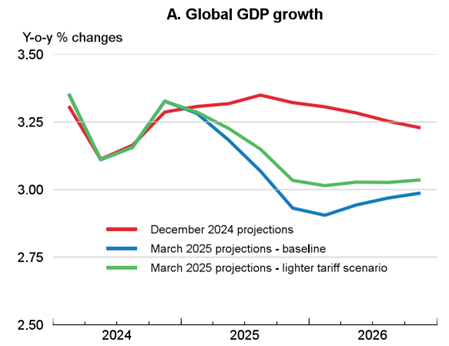

Source: OECD

Second, retail sales in February rose just 0.2% when economists were expecting a 0.7% rise. The ex-autos number was also weak (+0.3% vs. a +0.5% forecast). That could amplify concerns about the economy. The Organization for Economic Cooperation and Development (OECD) just cut its 2026 global growth forecast, while simultaneously raising its estimate for inflation.

Finally, markets will be closely watching to see what the Federal Reserve does and says this Wednesday. While Chairman Jay Powell and his fellow policymakers aren’t expected to cut short-term interest rates at this week’s meeting, they could provide important guidance on their views about inflation and growth. Rate futures markets are currently pricing in three 25-basis point cuts in 2025, up from only one a few weeks back.

S&P 500 5,638.94 (+2.1%) ↑ | VIX 21.85 (+0.37%) ↑ |

Dow Jones Industrial Average 41,488.19 (+1.65%) ↑ | Gold $2,995 per ounce (-0.2%) ↓ |

Nasdaq Composite 17,754.09 (+2.61%) ↑ | Oil $68.08 per barrel (+1.34%) ↑ |

Understanding the psychology of trading — and how to avoid pitfalls that can trip you up— is incredibly important to your long-term success. In this clip from our recent MoneyShow MoneyMasters Podcast, Adrian Manz of TraderInsight goes into more detail about what you need to know. Check it out HERE.

S&P 500: What Past Post-Inauguration Patterns Tell Us About 2025

👉️ TICKER: SPX

Tip-for-tap tariff policy has economic uncertainty swelling – and the market retreating in a manner that some are already comparing to Covid-19 and 2020. This seems like a reasonable comparison...but now is not 2020. I believe many of the market’s current concerns could be alleviated, advises Jeff Hirsch, editor-in-chief of The Stock Trader’s Almanac.

Silver: On the Cusp of a MAJOR Breakout

👉️ TICKER: SLV

It has been a wild month, pretty much across the board. The stock market has been volatile along with the economy and consumer sentiment. The end results are uncertainty and downward pressure. But silver is ready to shine brightly, write Mary Anne and Pamela Aden, editors of The Aden Forecast.

Are you Bullish or Bearish on Stocks? |