- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 03/12/25

TPTP 03/12/25

Mike Larson | Editor-in-Chief

Markets are rallying across the board on tamer-than-expected inflation data. Equities, Treasuries, gold, silver, and crude oil are all higher. The dollar is down.

We FINALLY got some not-so-lousy inflation data. Both the headline and core Consumer Price Indices rose 0.2% in February, less than the 0.3% gains that were expected. The year-over-year inflation rates decelerated to 2.8% and 3.1%. That could be just the thing to give markets a breather after an ugly stretch of trading. Still, economists remain concerned about the future given the potential inflationary impact of tariffs.

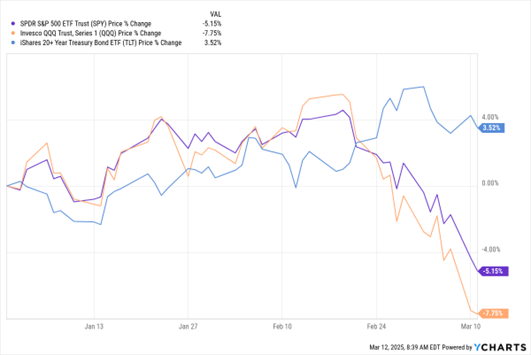

SPY, QQQ, TLT (YTD % Change)

Speaking of tariffs: Are some of President Trump’s own advisors getting worried about the damage his trade war talk and tariff flipflops are having? That’s what the Wall Street Journal suggested in a front-page story this morning (though Trump spokespeople denied the premise). The president just met with several CEOs, including the heads of International Business Machines Corp. (IBM) and Qualcomm Inc. (QCOM), and they reportedly warned him about the negative economic impacts of tariffs.

The administration’s 25% tariffs on steel and aluminum imports kicked in today, with no exceptions for countries or companies. Even staunch US allies like South Korea, Japan, and Australia must pay them. Meanwhile, the European Union responded by adding $28 billion of tariffs on US steel and aluminum products, home appliances, and agricultural exports.

As for Wall Street, rising volatility and a still-nascent rise in credit spreads is curtailing deal activity. While US Initial Public Offerings (IPO) rose 62% in value and more than doubled in deal count through early March, companies are starting to push deals into the future. Issuers are also starting to postpone corporate bond sales because rising volatility just pushed corporate bond spreads to five-month highs.

S&P 500 5,572.07 (-0.76%) ↓ | VIX 25.46 (-5.42%) ↓ |

Dow Jones Industrial Average | Gold $2,921.10 per ounce (+0.01%) ↑ |

Nasdaq Composite 17,436.10 (-0.18%) ↓ | Oil $67.17 per barrel (+1.37%) ↑ |

Todd Sullivan is president of Cannapreneur Partners, a Massachusetts-based cannabis holding company. In this informative session, he explains how cannabis revenues have never been higher, while valuations have never been lower. He’ll also explain why pension funds and even Berkshire Hathaway now have some new exposure to cannabis.

ABBV: A Higher-Yielding Healthcare Play That Continues to Shine

👉️ TICKER: ABBV

Selling accelerated this week after last week was the worst since September. The Nasdaq index is in correction territory, down 10% from the high. But even as the market is going to heck in a handbasket, AbbVie Inc. (ABBV) keeps chugging higher, observes Tom Hutchinson, editor of Cabot Income Advisor.CBOE: With Options Trading Surging, Own a Piece of the Action

👉️ TICKER: CBOE

As market uncertainty continues — and the chaos escalates — I’m going to talk about a company whose stock should benefit from uncertainty and powerful long-term storylines. It’s CBOE Global Markets Inc. (CBOE), explains Bill Patalon, chief stock picker at Stock Picker’s Corner.

Are you Bullish or Bearish on Stocks? |