- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 03/11/25

TPTP 03/11/25

Mike Larson | Editor-in-Chief

There’s not much nice to say about yesterday’s market action…but we are seeing equities attempt to stabilize in the early going today. Gold and silver are rallying along with crude oil, while Treasuries are flat. The dollar is continuing to slide after knifing through technical support several days ago.

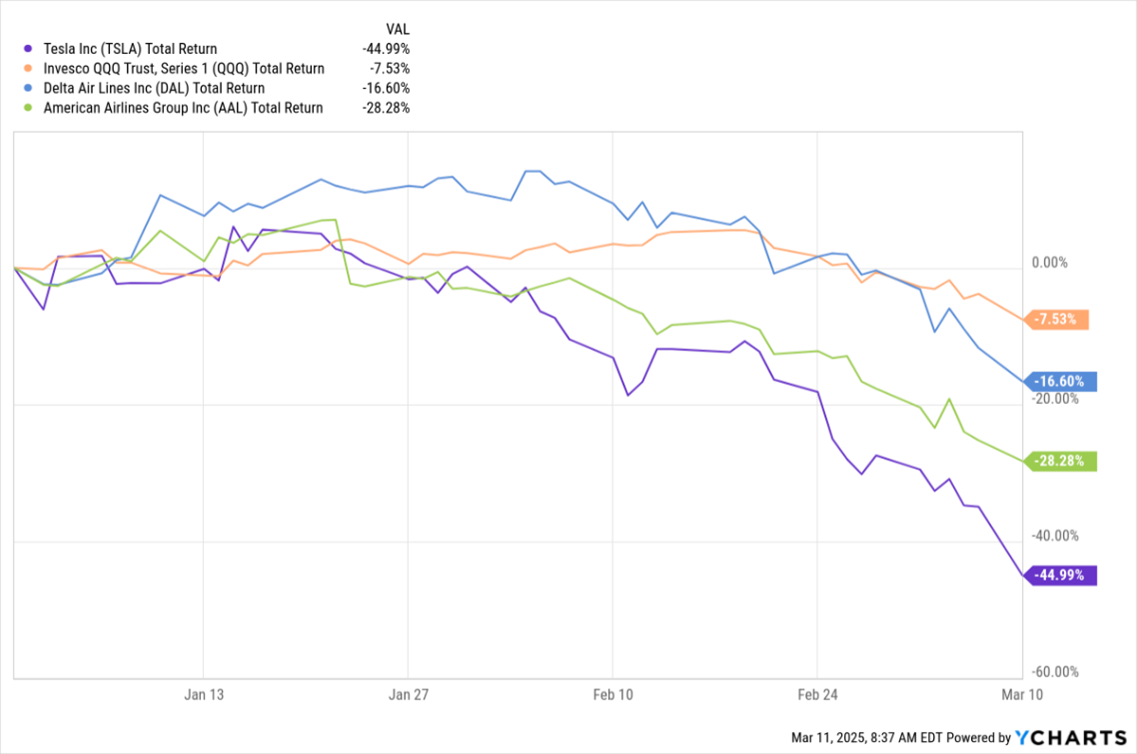

The “tech trade” has worked so well for so long. But things have gotten real ugly, real fast. The Nasdaq plunged 4% yesterday, its worst one-day performance since 2022. Many of the formerly magnificent seven stocks lost significant ground, with Tesla Inc. (TSLA) imploding 15%. That was its worst day since 2020, a move that boosted its year-to-date losses to around 45%.

TSLA, QQQ, DAL, AAL (YTD % Change)

What’s behind the ugly action? Confusion over the Trump Administration’s tariff and trade policy, along with rising recession fears. Interviews over the weekend didn’t help sentiment. But in a show of support for CEO Elon Musk, the president posted on Truth Social that he will buy a Tesla today.

Meanwhile, the airline industry is running into trouble. American Airlines Group Inc. (AAL) warned that on a per-share basis, it would lose 60 cents to 80 cents in the first quarter, compared with a previous forecast of 20 cents to 40 cents. Delta Air Lines Inc. (DAL) also slashed its Q1 sales and profit guidance. Both companies blamed declining consumer and business confidence and weakening domestic demand.

Finally, it’s the end of an era at Southwest Airlines Co. (LUV). Since it was founded more than five decades ago, the airline hasn’t charged passengers to check luggage. But after May 28, regular passengers will start paying fees for their first and second bags. Southwest has fallen on tough times recently. Its shares are down 15% in 2025, and the company just announced 1,750 layoffs.

S&P 500 5,614.56 (-2.7%) ↓ | VIX 27.84 (-0.07%) ↓ |

Dow Jones Industrial Average 41,911.71 (-2.08%) ↓ | Gold $2,919.20 per ounce (+0.68%) ↑ |

Nasdaq Composite 17,468.32 (-4%) ↓ | Oil $66.76 per barrel (+1.11%) ↑ |

With volatility rising notably, now is a good time to remember some advice from Brian Lund of The Lund Loop. Be careful not to self-sabotage as an investor or trader. See what he means in this excerpt from a November 2024 MoneyShow MoneyMasters Podcast segment I did with him.

Stocks: Where Weakness is Concentrated & What to Expect Next

👉️ TICKERS: SPY, QQQ

The US equity markets continued to be pressured by tariff and economic growth uncertainties during the week ending March 7. Weakness was most pronounced in the mid- and small-caps, the growth index, along with the energy, materials, and information technology sectors, notes Sam Stovall, chief investment strategist at CFRA Research.

AMGN: A Big Pharma Name Bucking the Bearish Market Trend

👉️ TICKER: AMGN

Trump’s manufactured trade war, a weak economy in China, and chaos in the White House over the federal work force have all threatened a full-scale retreat on Wall Street. There is a growing feeling that we face a recession in 2025. But big pharma company Amgen Inc. (AMGN) is bucking the trend, writes Mark Skousen, editor of Forecasts & Strategies.

Are you Bullish or Bearish on Stocks? |