- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 03/10/25 3

TPTP 03/10/25 3

Mike Larson | Editor-in-Chief

It’s looking like another dreary day for equities so far. Meanwhile, gold and silver are mixed…crude oil is modestly higher…and Treasuries are rallying again.

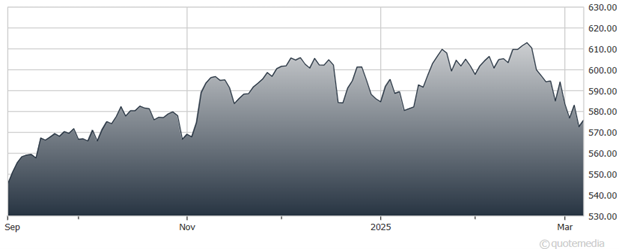

The stock market has been struggling for a few weeks now, with the S&P 500’s 3.1% decline last week the worst weekly drop in six months. Now, stocks are sliding again in the wake of media interviews suggesting the Trump Administration won’t let short-term market turbulence derail its long-term economic and political plans.

On Friday, Treasury Secretary Scott Bessent acknowledged there could be a “natural adjustment as we move away from public spending.” But he added that investors should prepare for a “detox period” – and said “there’s no put” coming from President Trump.

SPDR S&P 500 ETF (SPY)

Put options are used to protect against downside market moves. Many investors had assumed Trump would dial back tariff threats if markets fell (or in colloquial terms, give investors a “put” against further losses). But Bessent’s comments suggest otherwise.

For his part, the president told Fox News on Sunday that Americans should prepare for a “period of transition because what we’re doing is very big.” He added that “you can’t really watch the stock market” and declined to rule out the possibility of a recession this year. The dollar has been diving and Treasury yields have been dropping due to rising worries about economic weakness.

Finally, we got a modest-sized “Merger Monday” deal in the real estate sector. Rocket Cos. (RKT) announced plans to buy Redfin Corp. (RDFN) for $1.75 billion. Rocket is a Detroit-based fintech and mortgage lending firm, while Redfin is a real estate listing platform. The all-stock offer price of $12.50 per share is more than double where RDFN closed on Friday.

S&P 500 5,770.20 (+0.55%) ↑ | VIX 26.42 (+13.05%) ↑ |

Dow Jones Industrial Average | Gold $2,913.50 per ounce (-0.02%) ↓ |

Nasdaq Composite 18,196.22 (+0.7%) ↑ | Oil $67.21 per barrel (+0.24%) ↑ |

The market is struggling because of tough tariff and trade talk. So, what does the future hold? Find out from David Kotok, co-founder and CIO at Cumberland Advisors, in this snippet from my recent MoneyShow MoneyMasters Podcast segment with him.

A Nascent Rotation – and What it Means to Investors Like You

👉️ TICKERS: SPY, RSP

If I told you I had two baskets of stocks, and that both baskets contained the same stocks, you might immediately assume that both baskets have performed the same. After all, they are the same stocks, right? But that’s not the case – as you can see by comparing the SPDR S&P 500 ETF (SPY) and the Invesco S&P 500 Equal Weight ETF (RSP), writes Jim Woods, editor of Investing Edge.

BGC: A Fintech Play with Solid Growth & a "Strong Buy" Grade

👉️ TICKER: BGC

The markets just took a noticeable tumble. Nowhere was this more evident than in the frothy corners of the market: The high-flying, speculative stocks where greed overtook fundamentals and valuations. So, where’s the opportunity right now? I’m bullish on fintech stocks like BGC Group Inc. (BGC), advises Steve Reitmeister, editor of Zen Investor.

Are you Bullish or Bearish on Stocks? |