- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 03/05/25

TPTP 03/05/25

Mike Larson | Editor-in-Chief

Stocks have been sliding for days amid trade war fears, and yesterday was no exception. They’re flat in the early going today along with Treasuries and gold. The dollar is slipping, while Bitcoin is bouncing after a rough stretch of trading.

President Trump addressed Congress last night, making the case for his administration’s aggressive trade and tariff approach. While he acknowledged that his policies could cause a “little disturbance” in the short term, he said “tariffs are about making America rich again and making America great again” over the longer term.

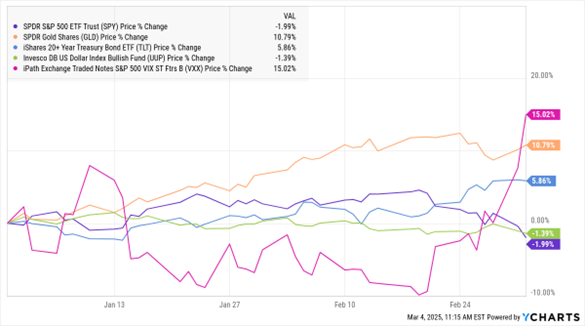

Will markets buy his argument? Over the past few weeks, that doesn’t seem to have been the case. Stocks have fallen, Treasuries have rallied, volatility has jumped, gold has climbed, and the yield curve has started re-inverting – all signs markets are worried about rising economic risks. Then this morning, ADP said the economy created just 77,000 jobs last month. That was a big drop from 186,000 in January, the smallest gain since July, and well below economists’ forecasts.

SPY, GLD, TLT, UUP, VXX (YTD % Change)

We won’t get the “official” jobs data from the Labor Department until Friday, but some pundits are already whispering the word “stagflation.” They warn that 25% tariffs on imports from Mexico, Canada, and maybe Europe...plus 20% tariffs on China...will drive up prices while weakening trade and growth. Still, Commerce Secretary Howard Lutnick suggested late yesterday that some kind of deal could be reached – and investors are hoping that’ll bear fruit.

If there’s one market sector that might find relief here, it’s housing. Long-term yields have been falling due to some of the forces described above – and that helped push 30-year mortgage rates to a three-month low. The dop of 15 basis points to 6.73% in the most recent week helped drive refinancing application activity up 37%. Home purchase loan apps popped 9%, according to the Mortgage Bankers Association.

S&P 500 5,801.19 (+0.40%) ↑ | VIX 23.95 (+1.87%) ↑ |

Dow Jones Industrial Average | Gold $2,922.60 per ounce (+0.07%) ↑ |

Nasdaq Composite 18,327.10 (+0.23%) ↑ | Oil $66.45 per barrel (-2.65%) ↓ |

The global economy is at a crossroads. Will this decade resemble the Roaring 1920s, a period of rapid technological progress and economic expansion? Or are we heading toward a 1990s-style market melt-up, driven by excessive speculation and inflated valuations, only to face an inevitable downturn?

Worse yet, could we be on the brink of a 1970s-style stagflation crisis, weighed down by inflation, mounting debt, and geopolitical turmoil? At our 2025 MoneyShow Las Vegas, renowned economist Ed Yardeni, president of Yardeni Research, provided an in-depth analysis of these three possible scenarios, weighing the probabilities of each and mapping out what investors should expect in the coming years. Check out what he had to say HERE.

Tariffs, Treasury Yields, and the Stagflation Threat

👉️ TICKERS: SPY, IEF, TIP, TNX

I'm sure you've been seeing these stats, but I’ll mention them here just in case. In 2024, the US imported about $413 billion worth of goods from Canada, $505 billion from Mexico, and $440 billion from China, including iPhones. I'm hopeful, as we all are, that these Canadian and Mexico tariffs are quickly removed in some sort of announced “deal,” observes Peter Boockvar, editor of The Boock Report.

ELV: A Healthcare Benefits Play with a Solid Dividend

👉️ TICKER: ELV

Elevance Health Inc. (ELV) is a healthcare benefits company serving nearly 46 million members through its plans. The company offers managed care plans to a wide range of markets, including individual, commercial, Medicare, and Medicaid, writes Ben Reynolds, editor of Sure Dividend.

Are you Bullish or Bearish on Stocks? |