- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 03/03/25

TPTP 03/03/25

Mike Larson | Editor-in-Chief

Stocks are steadying in the early going ahead of some potentially market-moving events. Gold and silver are rebounding, while the dollar is dropping notably. Crude oil is stable around $70 a barrel.

It’s “Tariff Eve,” with 25% levies set to take effect on Canadian and Mexican imports tomorrow. China’s tariff rate will also double to 20%. All told, tariffs could apply to around $1.5 TRILLION in annual imports barring a last-minute deal. Europe could be next in the line of fire, too.

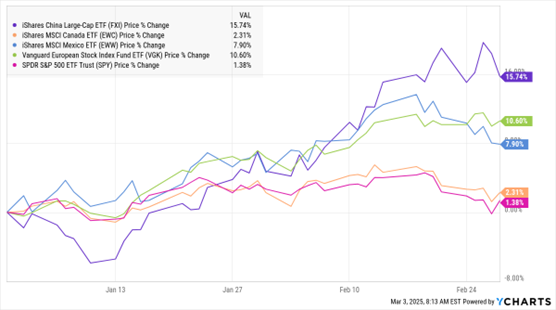

The targeted nations have said they would retaliate with tariffs on US exports, including US agricultural and food products in the case of China. Ironically, markets in many of the countries targeted by tariffs are outperforming markets in the US. The chart below shows the performance of ETFs that track stocks in China, Canada, Mexico, and Europe – along with the SPDR S&P 500 ETF (SPY).

FXI, EWC, EWW, VGK, SPY (YTD % Change)

Following a rough stretch of economic data, the February jobs report is set to be released at the end of this week. Economists think the unemployment rate will hold steady at 4%, while job creation will increase to 153,000. Any disappointment on either front could lead to increased bets on Federal Reserve interest rate cuts. Bond investors haven’t been looking for aggressive moves lately due to stalled progress on inflation.

President Trump gave cryptocurrency investors some (fleeting) relief over the weekend by pushing the idea of a Crypto Strategic Reserve again. The president suggested Sunday that any reserve could include other tokens like XRP, SOL, and ADA in addition to widely expected cryptos like Bitcoin and Ethereum.

Many cryptos surged on the news yesterday, though they gave back a chunk of those gains today. The administration’s crypto czar Davis Sacks is hosting a meeting with Trump and several industry executives this Friday.

S&P 500 5,954.50 (+1.59%) ↑ | VIX 19.51 (-0.61%) ↓ |

Dow Jones Industrial Average | Gold $2,884.70 per ounce (+1.27%) ↑ |

Nasdaq Composite 18,847.28 (+1.6%) ↑ | Oil $70.15 per barrel (+0.52%) ↑ |

Most people’s views of crypto are shaped by headlines that focus on price. But there’s a deeper reality: This new technology is fundamentally changing how people and businesses transact, store wealth, and verify and store data.

While it’s still early in crypto’s journey, we’re getting a glimpse of the future with crypto applications that millions already use every day, such as stablecoins, global payments, and prediction markets, from household names like PayPal and Visa.

Learn from Matt Hougan, Chief Investment Officer at Bitwise Asset Management, and a pioneer in the cryptocurrency and investment space. With his extensive experience as the former CEO of ETF.com and Inside ETFs, Matt brings a unique perspective, blending traditional finance with the cutting-edge world of digital assets.

He is a recognized thought leader who has helped shape the ETF industry and is now driving innovation in the cryptocurrency sector. Discover how crypto projects, while diverse, share a common theme: Innovators who want to improve the status quo are turning to crypto to make it possible.

AL: An Aircraft Leasing Play with a Full Order Book

👉️ TICKER: AL

Air Lease Corp. (AL) delivered better-than expected results in its fourth quarter ended Dec. 31, 2024, with revenues of $712.9 million, down 0.5% from Q4 2023, and GAAP EPS of $0.83, down 56.1%. Ironically, the EPS decline was due to demand trends, notes Doug Gerlach, editor of Small Cap Informer.

Why 10-Year Yields are Easing – and What it Means for Stocks

👉️ TICKERS: TLT, IEF

A little over a month ago as Donald Trump was about to take office as President, the 10-Year Treasury Note yield hit 4.80%. Almost every economist and strategist was writing and putting out that the 10-year would hit 5% due to inflation from tariffs. I disagreed – and I still do, writes Ryan Edwards, author at The Investing Authority.

Are you Bullish or Bearish on Stocks? |