- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 02/26/25

TPTP 02/26/25

Stocks were mixed yesterday, though they’re trying to recover in the early going today. Gold and silver are up a bit along with the dollar, while oil is sliding and back below $70 a barrel. Treasuries are mostly flat.

The future of the markets hinges on…Nvidia Corp.’s (NVDA) fourth-quarter earnings?? It may sound silly, but in the short-term, it’s true. Technology stocks, Bitcoin, and other high-momentum corners of the capital market have gotten crushed in the last several days. Many investors in those assets are hoping NVDA can right the ship.

Nvidia Corp. (NVDA)

The benchmark semiconductor maker and Artificial Intelligence (AI) poster child reports numbers at 4:20 pm Eastern. Analysts are looking for $0.84 per share in profit on $38.2 billion in sales, with the data center division expected to bring in the lion’s share of revenue at $34 billion. Investors will also be hoping for commentary from CEO Jensen Huang that eases concern about returns on AI investments and DeepSeek’s potentially negative influence on tech spending.

Speaking of tech stocks that fell on hard times...but are now getting a boost: Super Micro Computer Inc. (SMCI) shares are surging after the AI play finally submitted updated financial reports to the Securities and Exchange Commission. If it hadn’t, SMCI could’ve been delisted from the Nasdaq. SMCI shares soared last year, but subsequently tanked after a short-selling research firm questioned the firm’s financials.

Finally, consumer confidence is starting to fade amid ongoing worries about inflation and growth. Many of the “Trump Trades” put on post-election are running out of steam, too. Wall Street will be closely watching Washington in the coming weeks to see if the president can make progress on his various tax-cutting plans. An initial procedural vote in the House went the administration’s way, but many hurdles remain to the passage of a comprehensive bill.

S&P 500 5,955.25 (-0.47%) ↓ | VIX 19.01 (-2.16%) ↓ |

Dow Jones Industrial Average | Gold $2,908.20 per ounce (-0.33%) ↓ |

Nasdaq Composite 19,026.39 (-1.35%) ↓ | Oil $69.08 per barrel (+0.22%) ↑ |

AI stocks have been on fire, but can they keep climbing? Ahead of Nvidia Corp.’s (NVDA) earnings tonight, see what Dan Ives, Managing Director & Senior Equity Analyst at Wedbush Securities, said in this Feb. 13 MoneyShow MoneyMasters Podcast episode. He shares his expert insights on the future of AI, Big Tech, and stock market trends in 2025.

IEMG and IEFA: Benefiting from Rotation to Foreign Equities

👉️ TICKERS: IVV, IEMG, IEFA

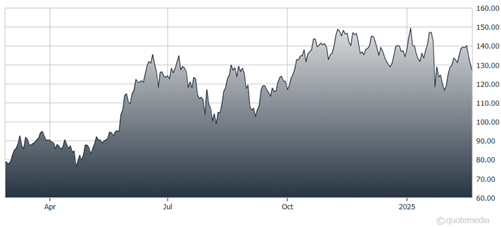

The last two calendar years have been outstanding for US equities. But we have seen some signs of reversal in sentiment around US market outperformance relative to other regions. The iShares Core S&P 500 (IVV) has recently trailed non-US ETFs like the iShares Core MSCI Emerging Markets ETF (IEMG) and iShares Core MSCI EAFE ETF (IEFA), advises Aniket Ullal, VP, ETF Data & Analytics at CFRA Research.Confidence: Consumers Losing Faith in Income, Job Prospects

👉️ TICKER: SPY

Consumer confidence continues to come off its election-fueled sugar high from November, with the most recent reading hitting its lowest level since June. Confidence has dipped for a third straight month, while also missing economists’ expectations in each instance, highlights Bret Kenwell, US investment analyst at eToro.

Are you Bullish or Bearish on Stocks? |