- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 9/30/25

Top Pros' Top Picks 9/30/25

Mike Larson | Editor-in-Chief

Investors are keeping a close eye on Washington as the shutdown countdown nears zero. Stocks, crude oil, gold, and silver are all pulling back modestly, while Treasuries and the dollar are mostly flat.

Markets are increasingly bracing for a government shutdown at midnight tonight after a White House meeting between President Trump and Republican and Democratic negotiators failed to produce a breakthrough. Democrats are pushing for health-care subsidy extensions, while Republicans want to fund the government through Nov. 21 and continue negotiations on longer-term issues between now and then.

As with past shutdowns, the economic impact of this one will depend on its length – and whether the administration follows through on threatened federal firings this time around. Hundreds of thousands of government workers will be furloughed and miss out on paychecks after Wednesday. Key data releases like Friday’s September jobs report from the Labor Department will also be delayed. If the shutdown drags on, government contractors will likely temporarily lay off workers, too.

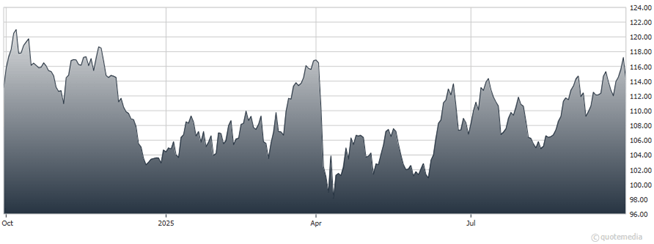

XOM (1-Year Chart)

Speaking of job cuts, energy giant Exxon Mobil Corp. (XOM) said it will let about 2,000 workers go – around 3% of its global workforce. Canada’s Imperial Oil Ltd. (IMO), which XOM owns 70% of, is also slashing 20% of its workforce. Crude oil prices have slumped almost 8% in the past year, causing the industry to retrench. Exxon has also been trying to boost efficiency and cut billions in annual costs via a multi-year restructuring process.

Finally, Citigroup analysts now say Artificial Intelligence (AI) infrastructure spending will top $2.8 TRILLION through 2029. That’s up from an earlier estimate of $2.3 trillion. Data centers packed with cooling equipment and massive amounts of tech gear are going up all over the country, while power-generation and transmission facilities are being built to serve them. But some observers worry too much money is being spent now for too little payoff later.

S&P 500 6,661.21 (+0.26%) ↑ | VIX 16.49 (+2.30%) ↑ |

Dow Jones Industrial Average 46,316.07 (+0.15%) ↑ | Gold $3,845.90 per ounce (-0.24%) ↓ |

Nasdaq Composite 22,591.15 (+0.48%) ↑ | Oil $62.74 per barrel (-1.12%) ↓ |

What’s MORE Magnificent than the Magnificent 7? Natalie Pace, author of the Amazon bestsellers The Power of 8 Billion: It's Up to Us and The ABCs of Money, shares her insights in this presentation from our recent MoneyShow Virtual Expo. Find out why her “2024 Investment of the Year” still looks attractive — and what other assets are spinning off even-greater gains than the Mag 7.

“Early Bird” Pricing Expires Thursday — Get Your 2025 Orlando Pass Today!

The 2025 MoneyShow/TradersEXPO Orlando will give you access to the nation’s sharpest financial experts — and the strategies and the recommendations you need to take your portfolio to the next level in the coming year. But if you don’t act by Thursday night, it’ll cost you MORE to get their help!

“Early Bird” pricing expires Thursday, Oct. 2 at 11:59 pm Eastern. So, don’t miss out. Lock in a $149 discounted Standard Pass TODAY (before it costs $50 more)!

SPY: Is it Time to REALLY Worry About Inflated Markets?

👉️ TICKERS: GLD, IBIT, SLV, XLRE, SPY

Stocks. Precious metals. Real estate. Cryptos. Just about every major investment class under the sun is sitting at or near all-time highs. But easy money is a drug, and a very dangerous one at that, notes Nilus Mattive, editor of Safe Money Report.

AUR: Driving Innovation in the Driverless Trucking Business

👉️ TICKERS: AMZN, AUR, FDX, GOOGL, TSLA

Artificial Intelligence (AI) is already streamlining repetitive tasks. Now, it’s replacing human judgement – driving 18-wheelers for 1,000 miles with no one at the wheel. Aurora Innovation Inc. (AUR) designs AI-powered platforms than make this possible, notes Adam Johnson, editor of Bullseye Brief.