- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 11/4/25

Top Pros' Top Picks 11/4/25

Mike Larson | Editor-in-Chief

Stocks are sliding as fresh bubble fears seep into markets. Gold, silver, and crude oil are all down, too, while Treasuries and the dollar are up a tad.

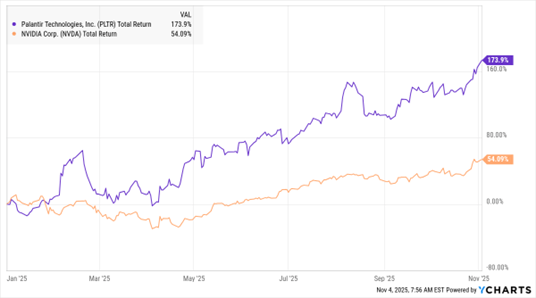

Palantir Technologies Inc. (PLTR) has been one of the hottest stocks in the hottest sectors – Artificial Intelligence (AI). The AI software and services company just reported stellar third-quarter results. Q4 sales guidance of $1.3 billion also topped Wall Street estimates, as did its operating profit projections. Yet the stock slid in early post-earnings trading, with analysts suggesting the results weren’t strong enough for a stock with an incredibly rich price-to-earnings ratio of 230!

PLTR, NVDA (YTD % Change)

Speaking of valuations, the “Cyclically Adjusted Price-to-Earnings” ratio from economist Robert Shiller may be flashing a warning. This Nobel Prize-winning economist’s “CAPE” ratio includes built-in business cycle-related adjustments, leading some to prefer it to standard measures. The valuation gauge recently hit 40.5. It has only touched these lofty levels once in data that goes back to 1881 – the tail end of the the Dot-Com bubble. In fairness, though, it has been rising for years...and that hasn’t derailed the post-2022 bull run.

Michael Burry of Scion Asset Management fame is reportedly targeting AI stocks, though. The hedge fund manager is stacking put options on names like Palantir and Nvidia Corp. (NVDA) – and posting bubble warnings on social media. Burry rose to fame thanks to his wildly profitable bets against various housing and mortgage-related instruments during the Great Financial Crisis (as portrayed in the movie The Big Short). But his more-recent bearish calls haven’t panned out.

Finally, the company behind late-night and early-morning meals with catchy names like “Moons Over My Hammy” is going private. The 72-year-old diner chain Denny’s Corp. (DENN) will sell itself to private equity firm TriArtisan Capital Advisors, owner of the P.F. Chang’s chain. The $322 million deal will remove DENN shares from the public markets for the first time in almost six decades. Denny’s has struggled in recent years, but still has approximately 1,600 restaurants.

S&P 500 6,851.97 (0.17%) ↑ | VIX 19.38 (+12.87%) ↑ |

Dow Jones Industrial Average 47,336.68 (-0.48%) ↓ | Gold $3,982.60 per ounce (-0.78%) ↓ |

Nasdaq Composite 23,834.72 (+0.46%) ↑ | Oil $60.21 per barrel (-1.38%) ↓ |

Worried about all the AI bubble talk? Then don’t miss this excerpt from my recent MoneyShow MoneyMasters Podcast with Ed Clissold! The chief US strategist at Ned Davis Research identified one thing that COULD help turn the AI boom into a bubble — and how investors should approach this market overall.

Get Expert Answers to Your Pressing Portfolio Questions - at Our 2025 Sarasota Symposium!

The S&P 500 just notched its longest monthly winning streak since 2021, while the Nasdaq had the longest stretch of “up” months since 2018. But BIG questions loom.

Is AI a runaway bubble...or a healthy boom? Is the recent reversal in gold and silver just a correction...or the start of something more? And what about NEXT year? What’s in store for stocks? Get expert answers to your pressing portfolio questions — at our 2025 MoneyShow Masters Symposium Sarasota (Dec. 1-3 at the Ritz-Carlton Sarasota)!

SPX: Will the November-December Pattern Play Out in 2025?

👉️ TICKER: SPX

Since 1945, the S&P 500 Index (^SPX) has recorded the best two-month price increase and frequency of advance (FoA) in November and December, rising an average of 3.1% and posting a 76% FoA. Despite a possible short and shallow digestion of recent gains, we continue to see share prices advancing through year-end, remarks Sam Stovall, chief investment strategist at CFRA Research.

QBTS: An Attractive "Pure-Play" in Quantum Computing

👉️ TICKER: QBTS

Training large Artificial Intelligence (AI) models eats through millions in power and compute. That means demand is exploding for silicon carbide chips, thermal cooling systems, high-efficiency power converters — the unsexy but essential backbone of the AI revolution. One stock I like is D-Wave Quantum Inc. (QBTS), writes Nicholas Vardy, editor of Microcap Moonshots.

👩💼 🧑🏭 The labor market is deteriorating for three very different reasons at once. Blaming only AI misses key structural shifts in the economy. (Opening Bell Daily)