- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 11/3/25

Top Pros' Top Picks 11/3/25

Mike Larson | Editor-in-Chief

Stocks are mixed in the early going after last week’s solid finish. Gold and silver are rising modestly, while the dollar, Treasuries, and crude oil are mostly flat.

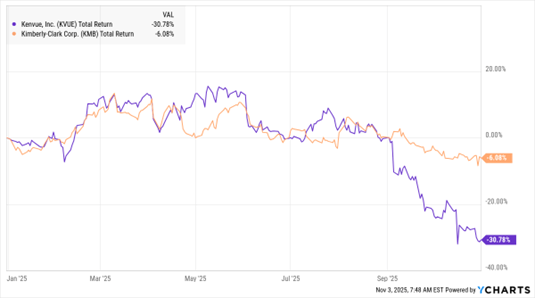

Consumer products giant Kimberly-Clark Corp. (KMB) is taking advantage of the Tylenol-driven slide in Kenvue Inc. (KVUE), announcing plans to buy the firm for $40 billion in cash and stock. The offer price of $21.01 is a 46% premium to where KVUE closed on Friday.

KVUE shares have been sliding for months amid comments from President Trump’s administration linking Tylenol usage to autism. But KMB said the deal would allow it to compete more effectively in high-growth consumer product categories. In addition to Tylenol, Kenvue makes products like Neutrogena lotions, Band-Aids, and Listerine mouthwash. Kimberly-Clark’s portfolio includes Huggies diapers, Scott toilet paper, and Kleenex tissues.

KMB, KVUE (YTD % Change)

Meanwhile, the government shutdown is entering another week – and closing in on the longest ever. The previous record of 35 days came in late 2018 and early 2019. Flight delays, closed national parks, missed paychecks, and lapsed aid programs are some of the existing or feared consequences.

Markets have managed to power ahead anyway, though economists and investors are watching for signs of spreading economic weakness. Private labor market data is softening, even as “official” numbers aren’t being reported due to the shutdown.

Finally, dealmaking in the Artificial Intelligence (AI) space shows no sign of letting up. Microsoft Corp. (MSFT) signed a $9.7 billion, five-year deal with IREN Ltd. (IREN) to give it access to computing power and Nvidia Corp. (NVDA) chips at the firm’s data centers. IREN operates facilities in British Columbia and Texas with total capacity of 2,910 megawatts. Its shares have soared more than six-fold this year thanks to the AI boom.

S&P 500 6,840.20 (+0.26%) ↑ | VIX 17.39 (-0.29%) ↓ |

Dow Jones Industrial Average 47,562.87 (+0.09%) ↑ | Gold $4,025.30 per ounce (+0.72%) ↑ |

Nasdaq Composite 23,724.96 (+0.61%) ↑ | Oil $61.10 per barrel (+0.20%) ↑ |

In this episode of the MoneyShow MoneyMasters Podcast, Lyn Alden Schwartzer, founder of Lyn Alden Investment Strategy and contributing analyst to ElliottWaveTrader.net, discusses fiscal dominance — the rising influence of government deficits and spending over central banks on markets and inflation. She explains how this shift creates a hotter, less cyclical economic environment and what it means for investors navigating these changes in 2025.

Lyn also shares insights on the surge in precious metals, Bitcoin, and foreign markets, offers a cautious outlook on US equities, and highlights the evolving impact of AI on the economy.

AAPL: The Big Tech Stock Wall Street Keeps Getting WRONG

👉️ TICKER: AAPL

I am well aware that I sound like a broken record. But Apple Inc. (AAPL) is most dangerous when people write it off like they did when shares sank to around $172 in April – and I told you in no uncertain terms it was a buy, says Keith Fitz-Gerald, editor of 5 With Fitz.

GPIX: A Covered-Call ETF for Income Investors to Check Out

👉️ TICKERS: SPX, GPIX

The S&P 500 Index’s (^SPX) dividend yield sits below 2%, hardly satisfying retirees or income seekers. Meanwhile, traditional bonds offer higher yields but still carry rate and inflation risks. Wall Street has taken note. The Goldman Sachs S&P 500 Premium Income ETF (GPIX) packages a covered-call strategy for mainstream income investors, points out Michael Gayed, editor of The Lead-Lag Report.