- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 10/31/25

Top Pros' Top Picks 10/31/25

Mike Larson | Editor-in-Chief

Happy Halloween! Stocks are trying to bounce back after a rough session on Thursday. Gold and crude oil are up a bit, while Treasuries and the dollar are essentially flat.

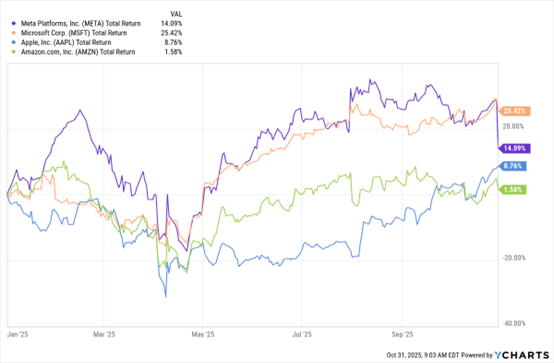

Will the bearish vibes from Meta Platforms Inc. (META) and Microsoft Corp. (MSFT) be offset by BULLISH vibes from Apple Inc. (AAPL) and Amazon.com Inc. (AMZN)? That’s what could be shaping up here. META and MSFT knocked markets for a loop yesterday by forecasting astronomical spending on Artificial Intelligence (AI) initiatives.

META, MSFT, AAPL, AMZN (YTD % Change)

META said CAPEX spending could hit $70 billion to $72 billion this year, raising the lower end of a previous forecast by $4 billion. It also said spending would be “notably larger” in 2026 amid its massive build out of data centers and computing equipment to fill them. For its part, MSFT spent a record $35 billion on CAPEX in the fiscal first quarter alone. It also said spending would rise for the full year, changing a previous forecast that it would moderate.

But then came earnings news from Apple and Amazon. The former said iPhone 17 uptake was strong and forecast Q4 EPS and sales that surpassed Wall Street expectations. As for Amazon, its stock soared to a record high after the company beat adjusted EPS forecasts by 24% – and revenue at its critical AWS cloud-computing division topped estimates.

Elsewhere on the earnings front, “Big Oil” companies Exxon Mobil Corp. (XOM) and Chevron Corp. (CVX) both topped forecasts thanks to acquisitions and production increases. But their shares were mixed in response because investors remain concerned about a global supply glut in the petroleum market. The Energy Select Sector SPDR Fund (XLE) is up 4.6% year-to-date, trailing the 17% rise in the SPDR S&P 500 ETF (SPY).

S&P 500 6,866.87 (+0.65%) ↑ | VIX 16.72 (-1.12%) ↓ |

Dow Jones Industrial Average 47,562.63 (+0.09%) ↑ | Gold $4,031.50 per ounce (+0.39%) ↑ |

Nasdaq Composite 23,871.83 (+1.23%) ↑ | Oil $61.08 per barrel (+0.84%) ↑ |

Markets got spooky this week! Federal Reserve Chairman Jay Powell’s “trick” rate cut rattled Treasury yields, while Meta’s AI forecast scared investors. But Apple and Amazon handed out sweet treats with monster earnings. Overall, the S&P 500 is on its longest “win” streak since mid-2021. But will the rally survive the turbulence in tech? Check out my take in today’s MoneyShow Video Market Minute!

INTC: Turnaround Story on Track Thanks in Part to Uncle Sam

👉️ TICKER: INTC

When Uncle Sam becomes your business partner, good things tend to happen. That’s exactly what we saw in Intel Corp.’s (INTC) first report with Washington riding shotgun, writes Thomas Hayes, editor of HedgeFundTips.

MAPTX: An Asian Stock Fund Benefitting from Foreign Market Strength

👉️ TICKER: MAPTX

US stocks rose to record levels in Wednesday trading before giving way after the Federal Reserve indicated there may not be a December interest rate cut. Meanwhile, for international stock funds, one of my new “Buys” this week is the Matthews Pacific Tiger Fund Investor (MAPTX), observes Brian Kelly, editor of MoneyLetter.

💵 📈 3 Dividend Aristocrats So Cheap, Analysts Call Them Buys. (Barchart)