- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 10/29/25

Top Pros' Top Picks 10/29/25

Mike Larson | Editor-in-Chief

Stocks are modestly higher after a rally Tuesday that lacked breadth. Gold and silver are bouncing after a big multi-day selloff, while crude oil, Treasuries, and the dollar are mostly flat ahead of a key policy meeting in Washington.

Yes, the stock market rallied yesterday...but it was one of the narrowest advances in ages. While the S&P 500 Index (^SPX) rallied 0.2%, the net advance/decline reading was NEGATIVE 294. Bespoke Investment Group notes that was the worst such divergence since at least 1990. In other words, we’re back to a market dominated by “Big Tech.”

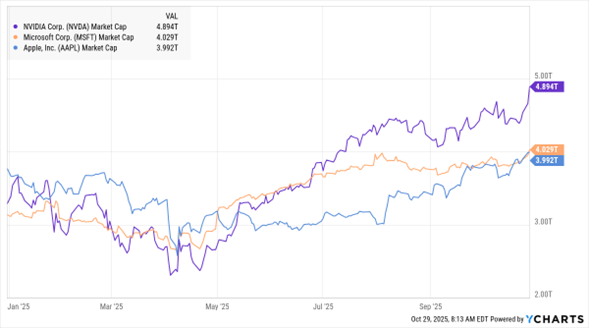

NVDA, MSFT, AAPL (Market Cap YTD Chart)

Consider Nvidia Corp. (NVDA). It’s topping the “$5 TRILLION in market cap” milestone in today’s session, the first company to do so EVER. A flurry of Artificial Intelligence (AI) deals and rampant investor enthusiasm for big tech names has driven NVDA’s valuation surge. The milestone comes just four months after Nvidia topped the $4 trillion mark.

Nvidia is also spreading the wealth around, announcing a deal yesterday to take a $1 billion stake in Nokia Corp. (NOK). In exchange, the Finnish communications company will buy NVDA chips and computers to build out its wireless networks and accelerate the growth of its data center business. NOK shares soared 21% on the news, the biggest one-day surge in 12 years.

It's worth noting that NVDA isn’t the only tech darling with a mind-boggling market cap. Both Microsoft Corp. (MSFT) and Apple Inc. (AAPL) aren’t too far behind, with valuations of roughly $4 trillion. Waiting in the wings is OpenAI, the dealmaking darling that reportedly plans to go public in 2027. If AI demand and AI spending continues to boom, the company could sport an eye-popping valuation down the road.

In other news, the Federal Reserve will conclude its latest policy meeting today. Policymakers are virtually guaranteed to cut interest rates by another 25 basis points, leaving the federal funds rate range at 3.75%-4%. But they are operating without key economic data due to the federal government shutdown. That clouds the outlook for more cuts – and investors will be watching Chair Jay Powell to see if he drops any hints about what’s next in his post-meeting press conference.

S&P 500 6,890.89 (+0.23%) ↑ | VIX 16.43 (+0.06%) ↑ |

Dow Jones Industrial Average 47,706.37 (+0.34%) ↑ | Gold $4,024.10 per ounce (+1.03%) ↑ |

Nasdaq Composite 23,827.49 (+0.80%) ↑ | Oil $60.11 per barrel (-0.07%) ↓ |

For over a decade, Bryan Perry has brought his expertise on high-yielding investments to his Cash Machine subscribers. In our recent MoneyShow Virtual Expo, he explained how investors can generate solid income and capital appreciation in this subsector of the thriving US energy market.

Nasdaq 100: Extremely Overextended Amid this Uneven Economy

👉️ TICKER: QQQ

The Nasdaq 100 Index is now almost 18% above its 200-day moving average. Meanwhile, I will argue again that we have an extraordinarily mixed and uneven economy, notes Peter Boockvar, editor of The Boock Report.

HLT: A Hotel Stock to Buy Amid Rising Room Demand and Higher Fees

👉️ TICKER: HLT

We are maintaining our “Buy” rating on Hilton Worldwide Holdings Inc. (HLT) and leaving our target price at $340. We believe that a recovery in business and leisure travel will lead to increased room demand, along with unit expansion and higher management fees, advises John Staszak, analyst at Argus Research.

🤝 📈 Nvidia's new deals overshadow everything else happening in markets. CEO Jensen Huang meets with President Trump Wednesday. (Opening Bell Daily)