- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 10/28/25

Top Pros' Top Picks 10/28/25

Mike Larson | Editor-in-Chief

Stocks are rallying further after a strong start to the week on Monday. Gold and silver continue to pull back, and today, they’re being joined by crude oil. The dollar and Treasuries are flat.

Amazon.com Inc. (AMZN) is planning big layoffs – at least 14,000 jobs across a range of white-collar divisions like logistics and payments. Though somewhat lower than the 30,000-job tally reported in various places yesterday, that would represent the biggest paring of workers in a few years. Amazon officials said they have to further trim a workforce that grew bloated in the post-Covid era, while also saying Artificial Intelligence (AI) tools will help the company accomplish more with less staff.

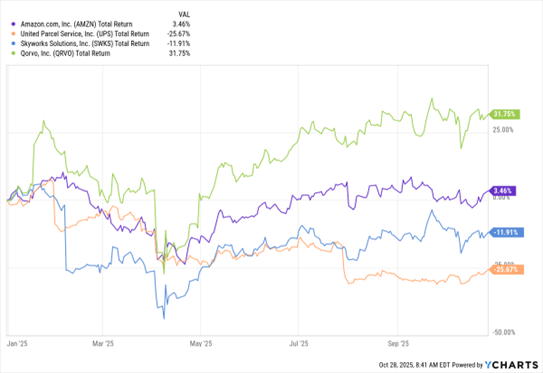

AMZN, UPS, SWKS, QRVO (YTD % Change)

Meanwhile, United Parcel Service Inc. (UPS) delivered an earnings home run in the third quarter – aided in part by 34,000 job cuts. The global shipping giant has shut various operations and trimmed its workforce of package handlers and drivers, moves that helped it deliver $1.74 per share in adjusted earnings. Wall Street analysts expected $1.32. The stock jumped 12% in early trading, its biggest gain since February 2022.

On the M&A front, chipmakers Skyworks Solutions Inc. (SWKS) and Qorvo Inc. (QRVO) are joining forces in a $22 billion deal. The companies make analog and mixed-signal chips for the wireless phone and automotive sectors, among others. Skyworks’ shareholders will own 63% of the combined company, while Qorvo holders will own the remainder. Shares of both tech names jumped on the news.

Finally, President Trump’s Asian tour continued yesterday and today with a visit to Japan. Trump heaped praise on Japan's new prime minister Sanae Takaichi, while officials outlined ways Japan would fulfill its pledge to invest up to $550 billion in the US. Next up for Trump is a meeting with the leader of South Korea, followed by the main event – a sit-down with Chinese leader Xi Jinping.

S&P 500 6,875.16 (+1.23%) ↑ | VIX 15.85 (+0.38%) ↑ |

Dow Jones Industrial Average 47,544.59 (+0.71%) ↑ | Gold $3,939.70 per ounce (-1.99%) ↓ |

Nasdaq Composite 23,637.46 (+1.86%) ↑ | Oil $60.48 per barrel (-1.35%) ↓ |

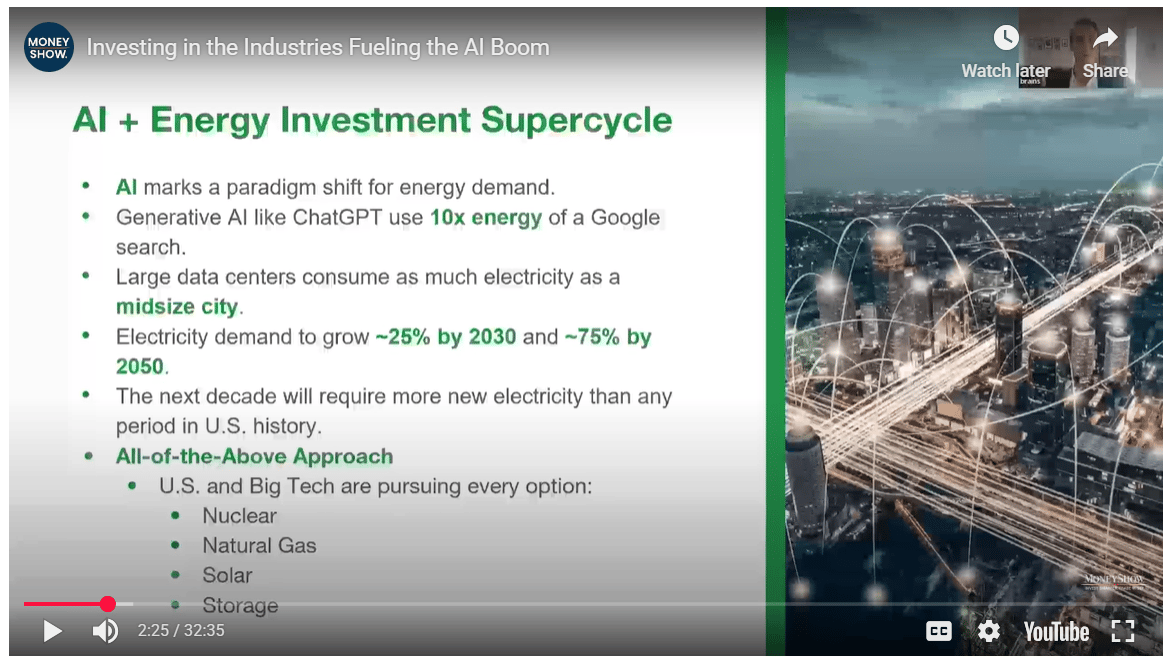

Without the massive and rapid expansion of reliable, always-on energy, the Artificial Intelligence (AI) age might be doomed to die on the vine. AI marks a paradigm shift for energy demand.

Large data centers can consume nearly as much electricity as a midsize city, and generative AI platforms like ChatGPT use at least 10x the energy of a typical Google search. In this presentation from our recent MoneyShow Virtual Expo, Zacks stock strategist Ben Rains dives into how much more energy/electricity the US will need – and which companies will profit from helping meet that demand.

Master Strategies for the New Year at Our Sarasota Symposium

When you attend our 2025 MoneyShow Masters Symposium Sarasota, you won’t just get a handful of stock picks. You’ll enjoy all this — and MORE — from Dec. 1-3 at the Ritz-Carlton…

==> Insight-rich keynotes and panels featuring heavyweights such as Liz Ann Sonders (chief investment strategist at Charles, Schwab & Co) and Ed Yardeni (president of Yardeni Research). Learn how markets will perform as the Federal Reserve cuts rates further and the 2026 midterm election cycle gets underway.

==> Deep-dives into high-flyers like AI and tech stocks versus challenger sectors such as materials and financials – and why this rotation may define the next leg of the bull market.

==> A full asset-class sweep with coverage of everything from stocks, commodities, and hard assets to digital currencies, private-market alternatives, and fixed income.

Stocks, AI, and Jobs: What Investors Need to Know Now

👉️ TICKER: SPX

The stock market rallied to all-time highs last week, with the S&P 500 Index (^SPX) closing at 6,791.69 on Friday. The index is up 15.5% year-to-date. Now, with AI technology sweeping across industries, let’s talk about what it means for the labor market in the coming years, writes Sam Ro, editor of Tker.co.

WES: A High-Yielding Energy Play with Occidental's Backing

👉️ TICKERS: BRK.B, OXY, WES

We see investor worries about energy dividends as well overblown. Accordingly, we’re adding Western Midstream Partners LP (WES) to the High Yield Energy List, explains Elliott Gue, editor of Energy and Income Advisor.