- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 10/27/25

Top Pros' Top Picks 10/27/25

Mike Larson | Editor-in-Chief

Markets are cheering talk of progress in the long-running US-China trade dispute. Stocks and crypto are higher, gold and silver are lower, while Treasuries and the dollar are flattish.

President Trump is on an Asian trip this week, one that has so far included a series of smaller “framework” deals with Southeast Asian nations like Thailand, Cambodia, Vietnam, and Malaysia. Later, he’ll be meeting with Chinese leader Xi Jinping in South Korea. Negotiators on both sides are trying to pile up as many “wins” that their leaders can announce, even as many bigger trade and geopolitical issues won’t be resolved.

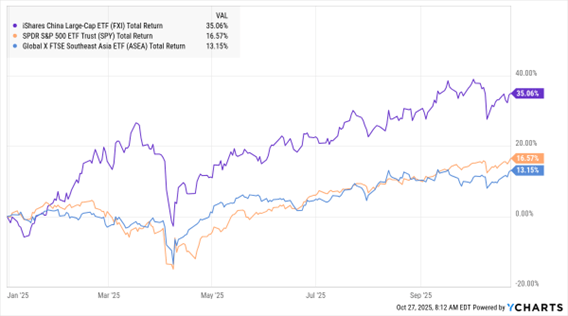

The US will likely back off Trump’s recent 100% tariff threat, while China will probably announce purchases of US soybeans and dial back some of its rare earth export restrictions. Progress toward détente helped markets rally around the world on Sunday and Monday. But it’s worth noting that the iShares China Large-Cap ETF (FXI) has been outperforming the SPDR S&P 500 ETF (SPY) all year, with gains of 35% versus 16.5% through last week. The Global X FTSE Southeast Asia ETF (ASEA) has lagged a bit, up 13.1%.

FXI, SPY, ASEA (YTD % Change)

There’s another bank deal to talk about today. Super-regional bank Huntington Bancshares Inc. (HBAN) is buying Cadence Bank (CADE) for $7.4 billion in stock. The move will add 400 Cadence locations in Texas, Mississippi, Alabama, Florida, and other Southern states to Huntington’s branch network. Bank mergers are heating up because the Trump Administration takes more of a laissez-faire approach to consolidation.

Meanwhile, Swiss drug giant Novartis AG (NVS) is buying US biotech company Avidity Biosciences Inc. (RNA) for $12 billion in cash. The $72 offer represented a 46% premium to where RNA traded on Friday. Novartis wants access to Avidity’s treatments for rare muscle disorders, including a development-stage drug for Duchenne muscular dystrophy called Delzota.

S&P 500 6,791.69 (+0.79%) ↑ | VIX 15.67 (-4.28%) ↓ |

Dow Jones Industrial Average 47,207.12 (+1.01%) ↑ | Gold $4,054.60 per ounce (-2.01%) ↓ |

Nasdaq Composite 23,204.87 (+1.15%) ↑ | Oil $61.48 per barrel (-0.03%) ↓ |

Trade talks in Asia are in focus this week, with markets watching to see if President Trump and Chinese leader Xi Jinping can hammer out a lasting deal that covers trade, tariffs, rare earth exports, technology sharing, and more.

In the meantime, check out my recent MoneyShow MoneyMasters Podcast episode with legendary emerging markets investor Dr. Mark Mobius. He highlighted several promising investment opportunities and markets in that part of the world.

Cooler Inflation Warms Hearts of Stock, Crypto Investors

👉️ TICKERS: IBIT, TLT, SPY

Headline inflation came in below economists’ expectations on Friday, giving risk-on assets like stocks and crypto a boost. Investors gained confidence in not just an interest rate cut this week from the Federal Reserve, but in getting another cut in December, notes Bret Kenwell, US investment analyst at eToro.

AI Stocks: Is "Circular Spending" REALLY a Big Problem?

👉️ TICKER: QQQ

The term “circular spending” can refer to two very different concepts: A potentially misleading and problematic financing technique in the business world, or a macroeconomic model for how money flows through an economy. This term has been brought up a lot lately - with reference to its less-than-positive version, writes John Gardner, founder and principal of Blackhawk Wealth Advisors’ Market Insights.