- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 10/22/25

Top Pros' Top Picks 10/22/25

Mike Larson | Editor-in-Chief

Gold and silver gave back more ground in the early going after an intense selloff yesterday. Equities and Treasuries are mostly flat, while crude oil and the dollar are rising modestly.

What started as a pullback Tuesday turned into a rout in the precious metals market, with gold sliding more than 6% (and another 3% this morning). That put the metal on track for its worst selloff in 12 years. Silver tanked more than 8% in a single spot market session, its biggest one-day selloff since 2021.

There were no obvious catalysts for the reversal, but metals had gotten wildly extended after the strongest annual rally since 1979. Wild enthusiasm about the “debasement trade” had led to extreme positioning, too. Options trading volume on the SPDR Gold Shares ETF (GLD) just hit its highest ever, while inflows into gold ETFs topped $8 billion last week, the most since at least 2018.

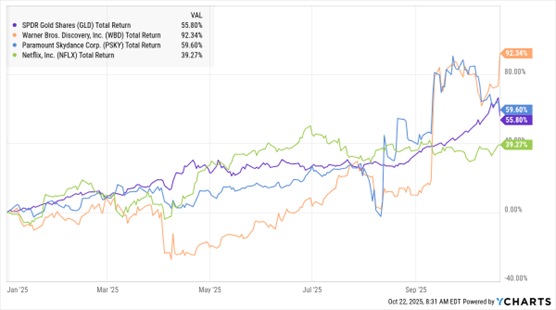

GLD, WBD, PSKY, NFLX (YTD % Change)

What’ll happen next with Warner Bros. Discovery Inc. (WBD)? Media industry observers want to know! Paramount Skydance Corp. (PSKY) is reportedly pursuing the movie, streaming, and cable network company, while the firm’s CEO David Zaslav would prefer to split the company in two on his own. Comcast Corp. (CMCSA) is also reportedly in the hunt.

WBD’s streaming business has 126 million subscribers, while its movie and television studios are well-respected. That accounts for the solid interest from other entertainment companies. Speaking of which, Netflix Inc. (NFLX) shares are plunging after the firm whiffed on revenue and profit forecasts in the third quarter. A tax dispute in Brazil of all places hurt results, and some investors remain concerned about engagement and valuation.

S&P 500 6,735.35 (+0.0%) ↑ | VIX 18.21 (+1.90%) ↑ |

Dow Jones Industrial Average 46,924.74 (+0.47%) ↑ | Gold $4,070.50 per ounce (-0.94%) ↓ |

Nasdaq Composite 22,953.67 (-0.16%) ↓ | Oil $58.46 per barrel (+1.11%) ↑ |

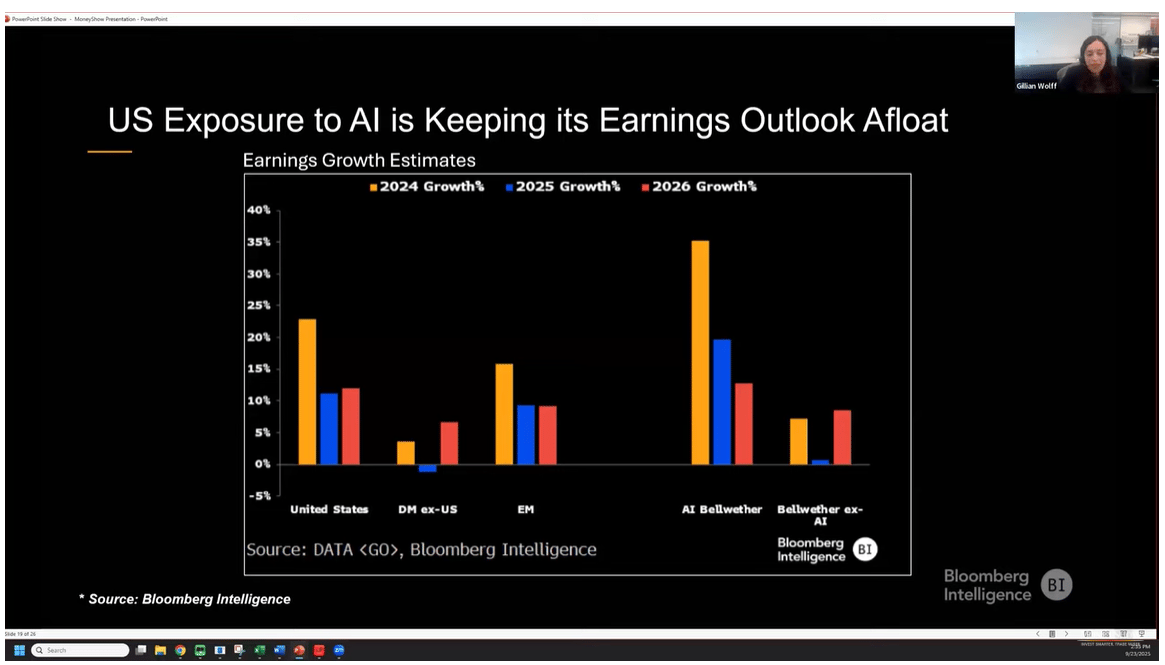

Throughout most of 2025, gains were largely concentrated in the biggest stocks. But could the rally be ready to broaden out to unloved corners of the market — like value and small cap stocks? Bloomberg Intelligence senior US equity strategist Michael Casper and equity strategist Gillian Wolff weighed in on that topic (and more!) at our recent MoneyShow Virtual Expo.

Fund Flows: US Stocks, Thematic ETFs Keep Drawing in Cash

👉️ TICKERS: XLU, XLV, SPY

Clean energy and semiconductors just powered a breakout week. According to data from our partner Trackinsight, US ETFs recorded strong inflows last week totaling $40.2 billion, led by equity ETFs with $26.1 billion and fixed income ETFs with $9.7 billion, writes Tony Dong, lead ETF analyst at ETF Central.

SCCO: A Copper Giant Benefiting from AI Boom, Energy Transition

👉️ TICKER: SCCO

Southern Copper Corp. (SCCO) is one of the world’s largest integrated copper producers, with a history dating to 1952. We believe the outlook for copper prices remains favorable. This backdrop supports a robust growth trajectory for SCCO, highlights Doug Gerlach, editor of Investor Advisory Service.