- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 10/20/25

Top Pros' Top Picks 10/20/25

Mike Larson | Editor-in-Chief

Stocks, gold, silver, and Bitcoin are all rallying in early trading. Crude oil is easing back, while Treasuries and the dollar are flattish.

The federal government shutdown has spilled over into another week, making this the third-longest episode on record behind those in 1995 and 2018-2019. A full pay cycle for federal employees will be missed if the shutdown persists through Friday, which is entirely possible given the lack of negotiating progress in Washington.

Various parts of the government, from the Supreme Court to the Army Corps of Engineers, are either already shut or winding down some operations and furloughing employees. But on Wall Street, business continues as usual. Roughly one-fifth of the companies in the S&P 500 Index (^SPX) are reporting quarterly results this week, including widely held names like Netflix Inc. (NFLX) and Tesla Inc. (TSLA).

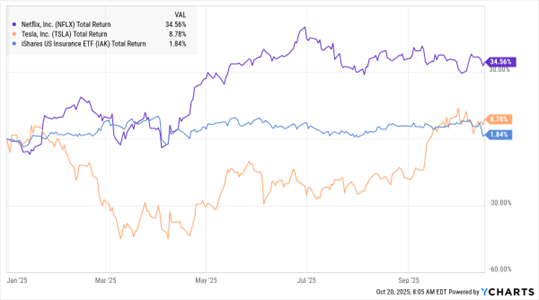

NFLX, TSLA, IAK (YTD % Change)

Floridians in “Hurricane Alley” aren’t the only ones facing massive increases in insurance costs these days. From sea to shining sea, the cost of protecting homes and autos is rising fast – with increases of 50% for homes and 42% for vehicles in the last five years, according to the Wall Street Journal.

That’s leading more states to reject rate hike requests or consider effective price controls, which critics say drives insurers out of those markets. For its part, the iShares US Insurance ETF (IAK) hasn’t done much this year. It was up just 1.8% on the year through Friday, lagging the 9.1% rise in the Financial Select Sector SPDR Fund (XLF).

Finally, Bloomberg published a fascinating story about how skyrocketing silver demand amid surging prices recently resulted in metals shortages from London to New Delhi. Premiums above benchmark spot prices soared and liquidity dried up as Indian buyers and global ETFs snapped up the metal, leading to chaos in key trading hubs. Here in the US, futures prices have eased back from a recent high of $53.76, but remain above $50.

S&P 500 6,664.01 (+0.53%) ↑ | VIX 20.19 (-2.84%) ↓ |

Dow Jones Industrial Average 46,190.61 (+0.52%) ↑ | Gold $4,340.20 per ounce (+3.01%) ↑ |

Nasdaq Composite 22,679.97 (+0.52%) ↑ | Oil $56.57 per barrel (-1.69%) ↓ |

What’s next for the crude oil and LNG markets? Anas Alhajji, managing partner of Energy Outlook Advisors, shared his insights at the 2025 MoneyShow Orlando. Check out this “MoneyShow 60” segment filmed at last week’s conference for more!