- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 10/10/25

Top Pros' Top Picks 10/10/25

Mike Larson | Editor-in-Chief

After intraday reversals to the downside yesterday, equities and precious metals are trading slightly higher today. Crude oil is lower, though, along with the dollar. Bonds are bouncing.

Markets have been ebullient since the “Liberation Day” wipeout…and now, retail traders are piling into stocks in a big way. Citigroup Inc. (C) tracks a basket of 46 retail-favored equities, and it said trading volume there just hit a record high.

Those retail-favored stocks are collectively up 30% since the start of September, trouncing the 4.3% gain for the S&P 500 Index (^SPX) in the same timeframe. Meanwhile, one JPMorgan Chase & Co. (JPM) measure of retail options selling activity just exploded to an all-time high. Analysts are divided about whether that could signal an imminent short-term top in stocks.

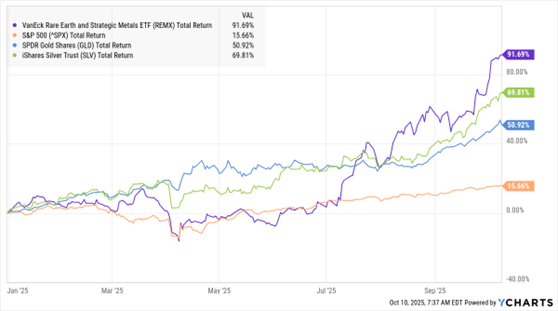

REMX, SPX, GLD, SLV (YTD % Change)

Meanwhile, China implemented new restrictions that could tighten global supplies of rare earth metals…a move that could reignite China-US trade tensions. China will now require exporters to get government approval before shipping certain goods abroad.

The restrictions apply to any product with rare earth materials equal to more than 0.1% of its value. A separate rule would restrict exports of lithium batteries and related equipment. Thanks to tightening supply and rising prices, the VanEck Rare Earths and Strategic Metals ETF (REMX) has surged more than 91% year-to-date.

Finally, the precious metals market is getting more volatile. Spot silver prices just topped $51 an ounce in London for the first time since 1980. But yesterday, US gold futures prices slid more than $100 an ounce at one point, breaking down through the $4,000 level before regaining it again. The moves come at a time of intense investor interest – with photos of Australian bullion buyers lined up around the block in Sydney making their rounds on social media.

S&P 500 6,735.11 (-0.28%) ↓ | VIX 16.52 (+0.55%) ↑ |

Dow Jones Industrial Average 46,358.421 (-0.52%) ↓ | Gold $4,001.60 per ounce (+0.73%) ↑ |

Nasdaq Composite 23,024.63 (-0.5%) ↓ | Oil $60.11 per barrel (-2.28%) ↓ |

When it comes to markets, everyone’s buying again. But should you? With gold over $4K, silver at $50, and retail-favored stocks ripping 30% in weeks, we COULD be setting up for a short-term top. Find out more in my video MoneyShow Market Minute!

AI Stocks: After Data Center Construction Boom, Will Profits Flow?

👉️ TICKERS: AMZN, GOOGL, META, MSFT, ORCL, QQQ

The lure of riches and tight capacity today has money flooding into the construction of Artificial Intelligence (AI) data centers. The irony is that, typically, the more money that floods into an area, the less likely any of the players will make the same juicy profits that attracted them, reaped in the years before the spending boom, notes Ed Yardeni, editor of Yardeni QuickTakes.

ESPR: Japanese Drug Approval, Otsuka Payments to Help this Biotech Play

👉️ TICKER: ESPR

Esperion Therapeutics Inc. (ESPR) and its partner Otsuka recently announced regulatory approval for NEXLETOL (bempedoic acid; oral ATP citrate lyase [ACLY] inhibitor) for hypercholesterolemia in Japan. Pending pricing, which ESPR estimates will take roughly one to two months, the company should receive a $120 million milestone from Otsuka, writes John McCamant, editor of Medical Technology Stock Letter.