- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 1/6/26

Top Pros' Top Picks 1/6/26

Mike Larson | Editor-in-Chief

After a broad-based rally yesterday, equities are mixed this morning. Metals continue to power ahead, while oil is up modestly, too. The dollar and Treasuries aren’t moving much.

The “Metals Mania” shows no sign of letting up in 2026. Gold and silver soared on safe haven buying yesterday following the raid in Venezuela, and both are higher again today. Meanwhile, base metals like copper are surging to new highs amid expectations that tariff policy and stronger demand could tighten market conditions further. The prices of other metals like zinc and aluminum are rising as well.

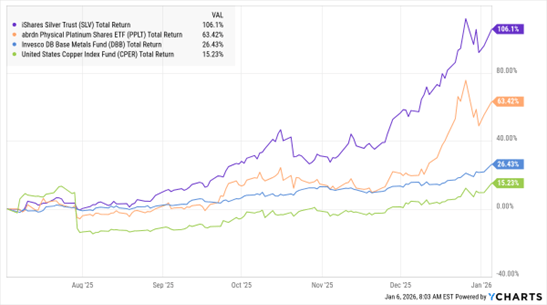

This chart shows the six-month performance of ETFs that track silver, platinum, copper, aluminum, and zinc. While the iShares Silver Trust (SLV) is the standout with a return of 106%, the Invesco DB Base Metals Fund (DBB) and the United States Copper Index Fund (CPER) have both perked up recently – with half-year gains now up to 26.4% and 15.2%.

SLV, PPLT, DBB, CPER (6-Mo. % Change)

Nvidia Corp. (NVDA) CEO Jensen Huang delivered a keynote address at the mammoth CES 2026 conference in Las Vegas yesterday. Huang touted advancements in robotics and self-driving cars based on its technology, while also revealing its latest AI server system, “Vera Rubin,” earlier than expected. NVDA stock has traded mostly sideways since August, but is up 30.2% in the last year.

Finally, it looks like the housing market could be in for another lackluster year barring any surprise move lower in mortgage rates. Thirty-year mortgage rates could drift down to 6.3% from an average of 6.6% in 2025, but that won’t move the needle much, according to Realtor.com’s senior economic research analyst Hannah Jones. Rising inventory in the South and West will help buyers out by softening prices, but markets in the Midwest and Northeast remain tight.

S&P 500 6,902.05 (+0.64%) ↑ | VIX 15.05 (+1.01%) ↑ |

Dow Jones Industrial Average 48,977.18 (+1.23%) ↑ | Gold $4,480.10 per ounce (+0.64%) ↑ |

Nasdaq Composite 23,395.82 (+0.69%) ↑ | Oil $58.65 per barrel (+0.57%) ↑ |

Peter Krauth is publisher of Silver Stock Investor. In this excerpt from my recent MoneyShow MoneyMasters Podcast episode, he explains why silver was quietly capped for years — and what force finally started breaking that ceiling. He also lays out his case for remaining bullish on 2026.

Get 68 “Top Picks” from 39 MoneyShow Experts — FREE!

Tomorrow is the big day! Our MoneyShow 2026 Top Picks Report will drop in the morning – and you’ll get to read about 68 red-hot picks for the new year. Submitted by 39 of our MoneyShow experts, they range from growth to value stocks, mega-caps to micro-caps. But they all share one thing in common: the potential for big gains!

Last year’s top-performing picks delivered hypothetical tracked gains of 567.7%, 400%, 148.7%, 146.3%, and 144.5%. Now, find out what the experts are recommending for THIS year…FREE. Just click the button below to get on the distribution list — then look for an email tomorrow with details on how to download your report.

SPX: Thoughts on a Downbeat December – and the Midterm Elections

👉️ TICKER: SPX

The S&P 500 Index (^SPX) recorded a price decline in its final month of 2025. Meanwhile, midterm election years (MTEYs) have the reputation of being quite challenging due to the uncertainty surrounding the upcoming November Congressional elections, observes Sam Stovall, chief investment strategist at CFRA Research.

IPX: A Metals Play for the "New Cold War"

👉️ TICKER: IPX

Our “Find the Best Storylines” strategy has an amped-up corollary: When multiple storylines intersect, go hunting. And that’s what we’ve got with the New Cold War. One recommendation I’ll share: IperionX Ltd. (IPX), writes Bill Patalon, chief stock picker at Stock Picker’s Corner.

🏆 📈 3 Best Dividend Aristocrats to Buy in 2026. (Barchart)