- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 1/20/26

Top Pros' Top Picks 1/20/26

Mike Larson | Editor-in-Chief

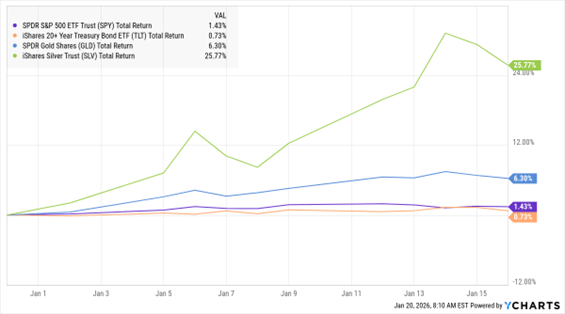

Stocks and bonds are selling off sharply, while precious metals are on fire. The US dollar is sharply lower, while crude oil is up modestly.

After a three-day weekend in the US, markets are a mess thanks to geopolitical and government bond concerns. On the first score, President Trump ratcheted up his threats to take control of Greenland – saying he’d slap eight European countries with additional tariffs if they didn’t back his move to annex the island. That’s raising investor concerns about a punishing new trade war, or as an even more-extreme outcome, widespread foreign selling of US Treasuries and other assets.

SPY, TLT, GLD, SLV (YTD % Change)

Meanwhile, global bond yields are surging after a lousy debt auction in Japan prompted concerns over Japanese fiscal health to boil over. Yields on Japanese 40-year government bonds climbed above 4% for the first time ever, while 30-year yields jumped the most since last year’s “Liberation Day” global market selloff.

Prime Minister Sanae Takaichi is trying to bolster the Japanese economy by slashing taxes and boosting spending – but the government is buried in debt. Yields on Japanese bonds have been rising for months in response, but today’s selloff was much more aggressive. Since other governments (including the US) are in a similar boat, the selloff went global. The yield on the US 30-year Treasury Bond just hit a four-month high of 4.94%.

The biggest beneficiary of all this chaos? Precious metals. Gold surged again – up more than $140 an ounce, or about 3%. Silver rose almost 8% to within $5 of a hundred bucks an ounce. Gold is up 73% in the last 12 months as a safe haven investment in an increasingly unstable world. For its part, silver has more than tripled.

S&P 500 6,940.01 (-0.06%) ↓ | VIX 20.30 (+27.99%) ↑ |

Dow Jones Industrial Average 49,359.33 (-0.17%) ↓ | Gold $4,749.40 per ounce (+3.35%) ↑ |

Nasdaq Composite 23,515.39 (-0.25%) ↓ | Oil $60.19 per barrel (+1.26%) ↑ |

In this keynote from the 2025 MoneyShow Orlando, Peter Schiff explains why de-dollarization and exploding deficits point to a coming currency and sovereign debt crisis. The chief global strategist at Euro Pacific Asset Management also explains how a 1970s playbook could work for you, why closing the gold window still matters, and what rising gold and silver prices may be signaling for bonds, rates, and the dollar. He closes with what to own, what to avoid, and how to position before the next market phase.

Immersive Market Education, Powerful Investing Picks — Yours at MoneyShow Las Vegas Next Month!

Join us for the premier gathering for self-directed investors and active traders — the 2026 MoneyShow/TradersEXPO Las Vegas, scheduled for Feb. 23–25 at the Paris Las Vegas. This three-day experience will bring together more than 1,000 market participants, 100+ exhibitors, renowned keynote speakers, and some of the most respected financial minds on Wall Street.

Whether you’re focused on stocks, AI and technology, crypto and digital assets, income opportunities, or active trading strategies, the MoneyShow Las Vegas offers unmatched access to expert research, actionable insights, and powerful networking events!

Top Picks 2026: Enghouse Systems Ltd. (ENGH.CA)

👉️ TICKER: ENGH:CA

Enghouse Systems Ltd. (ENGH.CA) has had a rough few years and is well below the highs set during the peak of the pandemic in 2020. But as contrarian investors, we have taken a stake in this enterprise and are anticipating a recovery in the years ahead, says Philip MacKeller, editor of Contra the Heard.