- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 07/01/25

Top Pros' Top Picks 07/01/25

Mike Larson | Editor-in-Chief

Equities are taking a breather after a fantastic second quarter. Crude oil, gold, and silver are rallying, though. Treasuries are flattish, while the dollar is dipping.

The stock market just notched its best quarter since 2023, and the S&P 500 just closed at a record high for two trading days in a row. But will the strength continue in Q3? Probably at least through July, according to Goldman Sachs Group Inc. (GS).

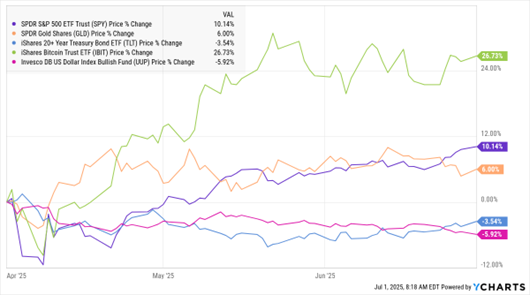

The firm noted that the S&P hasn’t dropped in any July since 2014. Plus, the index's average historical return for the month since 1928 is 1.67%. As for Q2, the SPDR S&P 500 ETF Trust (SPY) gained 10.1%, while the SPDR Gold Shares (GLD) rose 6% and the iShares Bitcoin Trust ETF (IBIT) surged 26.7%. ETFs that track long-term Treasuries and the dollar fell 3.5% and 5.9%, respectively.

SPY, GLD, TLT, IBIT, UUP (Q2 % Change)

Wall Street is continuing to eye the “Big Beautiful Bill” drama in Washington. President Trump wants a bill on his desk to sign by the Fourth of July. But disagreements about its budget-busting price tag, energy-related provisions, and other issues are holding things up. Tesla Inc. (TSLA) shares are also slipping amid a renewed feud between CEO Elon Musk and Trump over a bill provision that would tax green energy companies (and cost TSLA money).

Finally, the robot revolution is a very real thing at Amazon.com Inc. (AMZN). More than 1 million robots are now sorting, packing, and moving boxes and products around its warehouses – almost equal to the firm’s human workforce in those facilities. Each AMZN facility now averages 670 human workers, the lowest in 16 years. But Amazon officials say that many human workers are now training for and taking higher-paying jobs, even as menial and body-taxing tasks are being automated.

S&P 500 6,204.95 (+0.52%) ↑ | VIX 17.04 (+1.85%) ↑ |

Dow Jones Industrial Average 44,094.77 (+0.63%) ↑ | Gold $3,360 per ounce (+1.58%) ↑ |

Nasdaq Composite 20,369.73 (+0.47%) ↑ | Oil $65.44 per barrel (+0.51%) ↑ |

Are you navigating today's volatile markets and wondering where to find opportunity? In this insightful presentation from the 2025 MoneyShow Masters Symposium Miami, Kenny Polcari shares his unique institutional perspective on current market trends and what to expect next. The chief market strategist at SlateStone Wealth also reveals which stocks he's favoring, including top big-cap names in sectors like technology and financials.

Last Chance for “Early Bird” Pricing! Lock in Your $199 Vegas Pass TODAY

This is it. Today is your last day to lock in $199 “Early Bird” pricing on a MoneyShow MoneyMasters Symposium Las Vegas pass!

Get three-plus days of deep-dive market education, scores of portfolio picks, and invaluable trading guidance from top-of-their-game experts — without having to pay $50 more!

Enjoy our ALL-NEW venue, Caesars Palace…plus ALL-NEW experts, ALL-NEW Symposium features, and more!

Q3 Preview: After the Big Correction and Powerful Recovery in H1, What's Next?

👉️ TICKER: SPY

No one could fault an investor if at one point during the first half of 2025 they shouted, “Stop the world, I want to get off.” But now that the correction and first half of 2025 are over, what does history say awaits investors in the third quarter? Let’s take a look, writes Sam Stovall, chief investment strategist at CFRA Research.

APLD: A Data Center Play with Powerful Growth Potential

👉️ TICKER: CRWV, NFLX, NVDA, APLD

Applied Digital Corp. (APLD) is a rapidly expanding data center operator that is partnered with AI leaders. Data centers are the gold mines of the 21st century...places where discoveries happen and fortunes are made, advises Adam Johnson, editor of Bullseye Brief.

🏦 Investors' optimism for Fed rate cuts is drowning out tariff anxiety. Disinflation and a dovish shift at the central bank are fueling record stocks. (Opening Bell Daily)