- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 06/30/25

Top Pros' Top Picks 06/30/25

Mike Larson | Editor-in-Chief

It has been a WILD first half of the year for markets. Now, in the final trading day for Q2, stocks are rallying while the dollar is dipping. Gold and silver are mixed, while Treasuries and crude oil are flat.

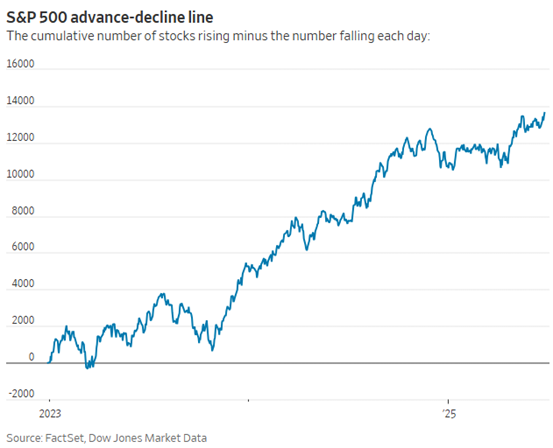

Overall, the S&P 500 has surged 24% from its early April low, pushing its year-to-date gain to 5%. Big Tech has been leading the charge, but many other stocks are now participating in the rally, too. Not only are we seeing the highest number of S&P 500 stocks trading above their 50-day moving averages since the fall, but the index’s advance-decline line just hit a fresh high.

Source: Wall Street Journal

At the same time, the US dollar is closing out its worst first-half of trading since 1973. The US Dollar Index has dropped more than 10% this year due to trade and tariff policy concerns, expectations for Federal Reserve interest rate cuts, and growing worries over US debts and deficits. On the flip side, gold has surged more than 24% and Bitcoin has gained 15%.

Meanwhile, North American trade policy is squarely in focus again – with markets getting an extra boost today after Canada took steps to unwind its “digital services tax” to placate President Trump. The 3% levy would have largely impacted US “Big Tech” companies like Meta Platforms Inc. (META) and Alphabet Inc. (GOOGL) – and raised billions of dollars in revenue for Canada’s government. But Trump suspended trade talks on Friday over the tax. Canadian officials are hoping the move will allow for the two countries to lock in a broader trade deal by July 21..

S&P 500 6,173.07 (+0.52%) ↑ | VIX 17.12 (+4.9%) ↑ |

Dow Jones Industrial Average 43,819.27 (+1%) ↑ | Gold $3,300.10 per ounce (+0.38%) ↑ |

Nasdaq Composite 20,273.46 (+0.52%) ↑ | Oil $65.51 per barrel (-0.02%) ↓ |

Thomas Lee is co-founder, managing partner, and head of research at Fundstrat Global Advisors and FSInsight.com. In this keynote address from our MoneyShow MoneyMasters Symposium in Miami, Tom explains how 2025 got off to a rocky start after a rollicking 2024. Then he provides his outlook for the rest of the year, including his expectations for the stock market, leading sectors, and Bitcoin and other cryptocurrencies.

CPRT: Buy the Recent Dip in this Vehicle Auction and Services Stock

👉️ TICKER: CPRT

Shares of Copart Inc. (CPRT) dropped more than 11% after the company reported muted fiscal third-quarter volume growth. Still, this is a company that applies a very long-time horizon to its investments, and its track record has been excellent, notes Doug Gerlach, editor of Investor Advisory Service.

CAI: Should You Buy This Newly Public Medical Test Provider?

👉️ TICKER: CAI

Certain companies become so deeply ingrained in our memories that we often make comparisons to them. For me, in certain parts of the healthcare industry, Theranos is that codified company. Enter Caris Life Sciences Inc. (CAI). The diagnostic and testing company has developed some groundbreaking testing regimes for precision medicine, observes Tyler Crowe, editor of Misfit Alpha.