- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 06/27/25

Top Pros' Top Picks 06/27/25

Mike Larson | Editor-in-Chief

Stocks are rallying – again – after both the S&P 500 Index (^SPX) and Nasdaq Composite tested fresh all-time highs yesterday. Gold and silver are giving back some ground, while crude oil is modestly higher. Treasuries are lower, while the dollar is flattish.

Trade-related headlines have been coming fast and furious in the last 24 hours. US Commerce Secretary Howard Lutnick said yesterday that a US-China deal solidifying terms previously agreed upon had been signed. China then confirmed that news this morning.

More talks on big-picture issues will be needed. But this first step should result in rare earth materials flowing to the US from China and things like ethane flowing to China from the US. White House officials separately characterized the upcoming July 9 “deadline” for additional trade deal negotiations as “not critical” – implying it’s flexible rather than set in stone.

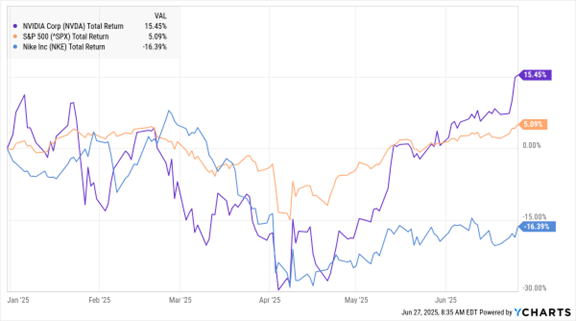

^SPX, NVDA, NKE (YTD % Change)

Meanwhile, the Trump Administration and Republicans in Congress are no longer pushing for a “revenge tax” of up to 20% on foreign companies. A provision in the large tax and spending bill being negotiated in Congress would’ve applied the tax to several countries. It was in retaliation for those countries not following through on a 2021 global agreement to reduce some taxes on US-based companies that have foreign operations.

In the markets, Big Tech is making a big comeback. I wrote about it in more detail in my Chart of the Day column here. But the move is powerful enough that Nvidia Corp. (NVDA) is close to becoming the world’s first $4 TRILLION company. The maker of advanced semiconductors is benefitting from the surge in Artificial Intelligence-related tech spending, and its ballooning valuation reflects that. As of yesterday’s close, NVDA’s market cap was $3.78 trillion.

Finally, shares of athletic gear and shoe maker Nike Corp. (NKE) are surging after it reported smaller-than-expected declines in quarterly sales and earnings. The firm said it faced $1 billion in tariff-related costs, but that it would mitigate them by raising prices and moving more production out of China. The stock entered today's session down 16% year-to-date.

S&P 500 6,141.02 (+0.80%) ↑ | VIX 16.14 (-2.71%) ↓ |

Dow Jones Industrial Average 43,386.84 (+0.94%) ↑ | Gold $3,293 per ounce (-1.64%) ↓ |

Nasdaq Composite 20,167.91 (+0.97%) ↑ | Oil $65.79 per barrel (+0.84%) ↑ |

Did you stay invested through the April market panic — and catch the subsequent rally? In this empowering presentation from the 2025 MoneyShow Masters Symposium Miami, Apex Group senior vice president Heather Zumarraga celebrates the savvy of retail investors who defied the institutional "panic selling."

You'll hear why the April 2nd "Liberation Day" lows created a massive opportunity, and how individual investors, unlike fast-moving hedge funds, often benefit by simply staying put. She also discusses the impact of political agendas and tariffs on market sentiment — and delves into the long-term implications of domestic energy policies.

SPONSORED BY PREFERRED COIN EXCHANGE

Preferred Coin Exchange: Your Source for Investment Grade Quality Rare Coins

Proven Long-Term Value: Rare coins have consistently appreciated over time, often outperforming traditional investments.

Limited Supply, Growing Demand: Rare coins are finite. As global interest in tangible collectibles grows, demand continues to rise — but supply cannot be replicated.

Portfolio Diversification: Numismatics offer a non-correlated asset class, providing balance against inflation, currency fluctuations, and geopolitical risk.

The Fed, the Dollar, and a Key Metal to Watch

👉️ TICKERS: PLTM, PPLT, SHV, SHY, UDN, TLT

What's becoming really clear is that whoever the next Federal Reserve Chair will be, easier money is going to have to be their mandate in order to satisfy the boss. Meanwhile, the US dollar continues to fall, particularly against the euro. The Dollar Index (DXY) just hit a fresh multi-year low, explains Peter Boockvar, editor of The Boock Report.

MSFT: Yes, its AI Investments Will Pay Off...Handsomely

👉️ TICKER: MSFT

It’s happening in real-time, yet most investors remain completely oblivious. The “it” is the Artificial Intelligence (AI) revolution, the greatest productivity accelerant since electricity. Let’s talk about what it means for Microsoft Corp. (MSFT), writes Joe Markman, editor at Digital Creators & Consumers.

🚗 Down 19% in 2025, What’s Next for Tesla Stock? It’s been a major news week for Tesla Inc. (TSLA), starting with the highly anticipated launch of its autonomous vehicle (AV) service in Austin - but also including some significant low points. (Barchart)