- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 06/20/25

Top Pros' Top Picks 06/20/25

Mike Larson | Editor-in-Chief

Stocks are rallying from overnight lows, though still largely marking time amid ongoing Middle East concerns. Gold and silver are pulling back, while crude oil has given back some recent gains. Treasuries and the dollar are modestly lower.

The Middle East crisis continues to dominate the attention of markets. President Trump has announced a two-week deadline for diplomatic talks to proceed on the Iran-Israel conflict. The US could jump into the fray after that (or sooner) to help Israel further damage Iran’s nuclear and missile research and weapons programs. European foreign ministers and Iranian officials are holding talks in Geneva today.

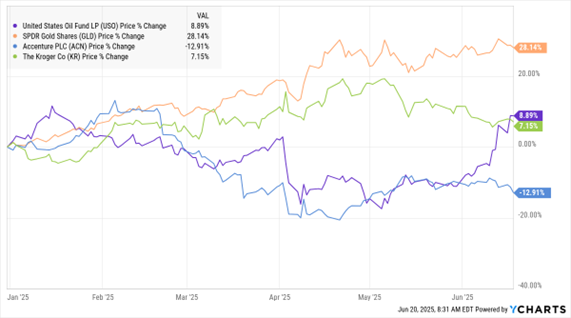

USO, GLD, ACN, KR (YTD % Change)

Crude oil markets have a $7-$8 per barrel “war premium” built into them right now. Gold has also been supported by the “safe haven” bid. Both commodities could give back some ground if we see any substantial de-escalation.

We’re in a corporate earnings lull, with the second-quarter reporting season not set to start for a couple more weeks. Analysts are expecting Q2 earnings growth of 4.9% for S&P 500 companies, down from 13.3% in Q1, according to FactSet. Still, a few reports are trickling in – and getting noticed.

Shares of the giant consulting firm Accenture (ACN) slid after contract bookings dropped 6% to $19.7 billion. It’s vulnerable to spending cutbacks by the US government given its federal contract exposure. For its part, grocery store chain Kroger Inc. (KR) raised its sales growth forecast for the year – though it highlighted how uncertain its outlook remains due to US economic concerns. Coming into today, ACN was down 12.9% while KR was up 7.1% year-to-date.

S&P 500 5,980.87 (-0.03%) ↓ | VIX 19.46 (-3.38%) ↓ |

Dow Jones Industrial Average 42,171.66 (-0.10%) ↓ | Gold $3,364.40 per ounce (-1.28%) ↓ |

Nasdaq Composite 19,546.27 (+0.13%) ↑ | Oil $75.39 per barrel (+0.33%) ↑ |

If you haven’t seen this week’s episode of the MoneyShow MoneyMasters Podcast, I strongly recommend you check it out. The double-length episode features Anas Alhajji, managing partner at Energy Outlook Advisors, and Joseph Cavatoni, senior market strategist for the Americas at the World Gold Council.

They share key insights on crude oil, gold, and the Middle East crisis — including what threats are being OVERhyped in oil…and why gold is more than just a short-term “safe haven” trade. It’s critical guidance at a crucial time for investors!

Just Added to Our Vegas Program: AI Profits Pre-Show Event July 14!

We just put the finishing touches on a special PRE-SHOW event for the 2025 MoneyShow Masters Symposium Las Vegas – and you are NOT going to want to miss it!

Called The Path to AI Profits: Data Centers, Power Sources, Software, & More, it will feature several NEW expert speakers covering Artificial Intelligence trends – and investment picks.

Event speakers include Sydney Armani, chairman and CEO, AI Fintech World Group...Roland McClean, senior associate at The Deal Alliance...Tom Taulli, author of Generative AI: How ChatGPT and Other AI Tools Will Revolutionize Business...Michael Lee, founder of Michael Lee Strategy...Roger Conrad, managing partner at Capitalist Times...and Merlin Rothfeld, senior director at the Trading Academy.

USO: Two Things to Consider if You're Using this ETF to Trade Oil

👉️ TICKER: USO

Oil prices are climbing again amid Middle East tensions. On the finance side, this has reignited investor interest in oil ETFs. But if you weren’t around for the wild ride of the 2020 Covid oil crash – and the flood of panicked questions from investors confused about why their oil ETFs didn’t match oil prices – now’s a good time for a quick reality check, explains Tony Dong, lead ETF analyst at ETF Central.

ALB: A Screaming Bargain in the Lithium Space

👉️ TICKER: ALB

Our favorite theme heading into 2025 was “Last Shall Be First,” with healthcare and materials as our top two sectors. So, let’s talk about Albemarle Corp. (ALB), the world’s largest and lowest-cost lithium producer, says Tom Hayes, editor of HedgeFundTips.

💰 3 Dividend Growth Stocks To Buy and Hold Forever. Some say that dividend Investing is boring. But when all things fail, these boring stocks prevail. (Barchart)