- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 06/18/25

Top Pros' Top Picks 06/18/25

Mike Larson | Editor-in-Chief

Markets around the world are on pins and needles, making only muted moves as traders wait to see if the US joins the fight against Iran. The calm follows a late selloff in stocks yesterday after rumors of potential US involvement spread.

As for the latest developments, President Trump met with his national security team yesterday and urged Iran’s president to agree to “unconditional surrender.” He also spoke to Israeli Prime Minister Benjamin Netanyahu.

Then this morning, Iran’s Supreme Leader Ayatollah Ali Khamenei appeared to reject the surrender request, adding that US participation in attacks on Iran would cause “irreparable damage.” He did so even as more US ships, planes, and other assets are being sent to the region. Those moves would give the US more military options if Trump decides to launch attacks.

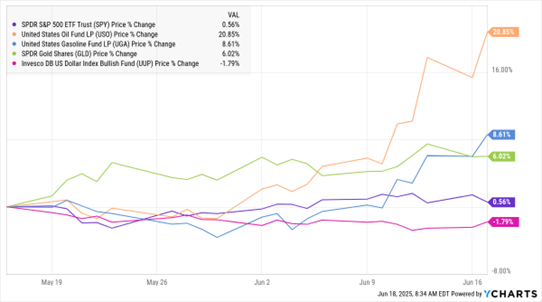

SPY, USO, UGA, GLD, UUP (1-Month % Change)

This chart shows how ETFs that track several major markets have traded in the past month – or in other words, both before and after the conflict began. The SPDR S&P 500 ETF (SPY) is roughly unchanged. But the United States Oil Fund (USO) has surged almost 21%, while the United States Gasoline Fund (UGA) has risen almost 9%. The SPDR Gold Shares (GLD) has gained 6%, while the Invesco US Dollar Index Bullish Fund (UUP) has lost 1.7%.

Meanwhile, the Federal Reserve’s latest policy meeting will conclude later today – and new “Dot Plot” forecasts from Fed members will be released. They’ll show what policymakers think will happen with inflation, unemployment, interest rates, and other indicators over the next several quarters.

Fed Chair Jay Powell & Co. won’t cut rates today. But markets will be watching those forecasts – and listening to what Powell says in today’s post-meeting press conference – closely. Investors are also wondering when Trump will announce a successor to Powell, whose term ends in just under a year. The president has made no secret of his disdain for Powell and the Fed’s reluctance to cut rates so far in 2025.

S&P 500 5,982.72 (-0.84%) ↓ | VIX 21.32 (-1.30%) ↓ |

Dow Jones Industrial Average 42,215.80 (-0.70%) ↓ | Gold $3,405.20 per ounce (-0.05%) ↓ |

Nasdaq Composite 19,521.09 (-0.91%) ↓ | Oil $75.29 per barrel (+0.60%) ↑ |

Ryan Modesto is portfolio manager at i2i Capital Management, as well as a CFA charter holder. In this session from our May 2025 MoneyShow Virtual Expo, Ryan takes a look at the state of the small-cap and mid-cap arenas. He discusses why he views the set of opportunities in this space to be larger than in other areas of the market — and shares a few stock ideas that are catching his eye.

Learn How to Allocate Your Portfolio Assets — in Las Vegas!

🎰 Join hundreds of economists, strategists, traders, authors, and fellow investors and traders for the 2025 MoneyShow Masters Symposium Las Vegas July 15-17 — at our ALL-NEW VENUE, Caesars Palace

📈 Get guidance and picks for your stocks, bonds, commodities, real estate, and alternative investments — from experts like Larry McDonald, Mark Mahaney, Victoria Fernandez, Paul Hickey, Stephanie Link, and Louis Navellier

💻 Enjoy live demonstrations, spirited panel discussions, and deep-dive courses on options, precious metals, and cryptocurrency trading — from top traders like John Carter, Michael Khouw, Bob Lang, Huzefa Hamid, and Bruce and Tammy Marshall

NFLX: A Great Example of How Adaptation Can Pay Off

👉️ TICKERS: BRK.A, NFLX

Having a great product to sell isn’t enough to have a business that’ll generate a great return for shareholders for many years to come. You also must have stellar management with a killer instinct for allocating capital. Netflix Inc. (NFLX) is a great example, advises Sam Ro, editor of Tker.co.

LEN: A Beaten-Down Builder with the Worst Priced In?

👉️ TICKER: LEN

Stocks fell yesterday after President Trump cut his G-7 visit short, dashing hopes for breakthroughs on trade. However, Canadian Prime Minister Mark Carney said that Canada and the US are still aiming for a trade deal within 30 days. Meanwhile, results from homebuilder Lennar Corp. (LEN) were mixed, notes Amber Kanwar, host of the In the Money with Amber Kanwar podcast.

🏦 Powell will stay hawkish in final year as Fed Chair — mirroring Greenspan, Bernanke and Yellen. Markets see two rate cuts at most in 2025. (Opening Bell Daily)

📈 ETF adoption has exploded. There were $426 billion worth of net inflows pumped into ETFs in the fourth quarter of 2024 with private credit, CLOs, cryptocurrency-based vehicles all growing quickly. ETF Upside is your key to understanding this fast-moving ecosystem. Built for advisors and capital advisors, it's quickly become a must-read. Sign up for free here. (Sponsored)