- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 06/17/25

Top Pros' Top Picks 06/17/25

Mike Larson | Editor-in-Chief

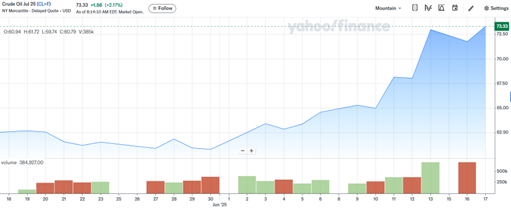

Crude oil and stocks continue to vacillate amid uncertainty about what comes next in the Middle East. Oil prices were recently up about 2%, while equities were off modestly. Gold and silver were mixed, while Treasuries were rallying. The dollar was flat.

What will happen next in the Israel-Iran conflict? Investors are trying to figure it out after President Trump left the G-7 meeting in Canada early, then said he was trying to find a “real end” to the conflict versus a simple cease-fire. Meanwhile, Israel has continued to strike Iranian targets – even as reports emerged that the Iranian regime was looking for a way out of a conflict it appears to be losing.

Crude Oil Futures (1-Month Chart)

Source: Yahoo Finance

WTI oil futures were recently trading around $73, while Brent futures were changing hands around $75. The US benchmark is well above its low from last month of $57-and-change…but still several dollars under its high for 2025. That was around $80, set back in January.

No one (myself included) expects the Federal Reserve to cut interest rates at the meeting that concludes tomorrow. Now, Fed “whisperer” Nick Timiraos at the Wall Street Journal has weighed in with an article suggesting the Fed might wait to cut even longer afterward. Officials are reportedly concerned that higher inflation expectations driven by tariff policy will lead to higher inflation itself as businesses raise prices and consumers ask for higher wages to compensate.

That means a cut could be off the table at the Fed’s July meeting, too. But if employment data keeps fraying around the edges as it has been, the Fed’s hand could be forced by September. Markets were recently pricing in a 59% chance of a 25-basis point cut at that month’s gathering.

Finally, shareholders at Verve Therapeutics Inc. (VERV) are waking up to a nice payday. Eli Lilly & Co. (LLY) said it would buy the startup for $1.3 billion to expand a push into experimental gene-editing treatments. The $10.50 offer price represented a 67% premium to where VERV shares closed on Monday.

S&P 500 6,033.11 (+0.94%) ↑ | VIX 20.11 (+5.23%) ↑ |

Dow Jones Industrial Average 42,515.09 (+0.75%) ↑ | Gold $3,406.70 per ounce (-0.31%) ↓ |

Nasdaq Composite 19,701.21 (+1.52%) ↑ | Oil $73.20 per barrel (+1.99%) ↑ |

Are you still questioning whether Bitcoin has real value — while missing the biggest supply squeeze in crypto history? In this presentation from our 2025 MoneyShow Masters Symposium in Miami, Bitwise Chief Investment Officer Matt Hougan breaks down exactly why Bitcoin could hit $200,000 this year — and how it's all about simple supply and demand math that most investors are completely missing.

You'll hear why Bitcoin provides a valuable service (storing wealth without banks), how ETFs bought more than 100% of all new Bitcoin supply in 2024, why corporations and governments are creating an unprecedented demand surge, and what the structural supply shortage means for price. Plus, Matt reveals why Bitcoin has been "substantially de-risked" since the early days.

APP: Should You Buy the App Services Stock After Recent Pullback?

👉️ TICKER: APP

AppLovin Corp. (APP) stock plummeted more than 12% over five days last week, emerging as the worst-performing stock in the Nasdaq-100 Index over that time frame. Still, the current analyst consensus on Wall Street is projecting 85.7% earnings growth for 2025 and second-quarter earnings at $2.01 per share, representing a 125.8% increase from the previous year, notes Elizabeth Volk, senior editorial director at Barchart.

Fed: On Tap to Sit Tight Amid Mixed Inflation, Employment News

👉️ TICKERS: SHV, SHY, TLT, SPY

The moment Fed watchers have waited for is finally here — albeit with less drama than many believed a few weeks back. Even as headline inflation measures appear to moderate, the robust labor market, evidenced by May's 4.2% unemployment rate, leaves Federal Reserve Chair Jerome Powell with little urgency to ease, writes Ed Yardeni, editor of Yardeni QuickTakes.