- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 06/16/25

Top Pros' Top Picks 06/16/25

Mike Larson | Editor-in-Chief

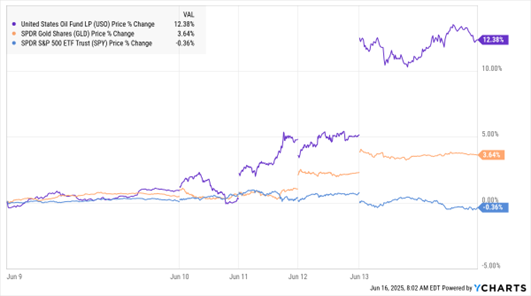

Crude oil is taking a breather after a couple big days of gains. Gold is also easing back after hitting a fresh record Friday, while equities are rallying. Treasuries and the dollar are down a bit.

Markets are cautiously optimistic here on Monday morning – but traders remain wary of developments out of the Middle East. Strikes and counterstrikes continued in Israel and Iran over the weekend, with Israeli forces reportedly gaining air superiority and operational flexibility in Iran. Still, Iran has still been able to launch almost 400 missiles and hundreds of drones at Israel, attacks that have killed and wounded dozens.

USO, GLD, SPY (5-Day % Change)

While there have been limited attacks on energy facilities in both countries, we haven’t (yet) seen the widespread destruction of oil-exporting or storage facilities. Iran also hasn’t fully committed to trying to shut down the Strait of Hormuz. That has allowed oil prices to stabilize after big increases late last week and Sunday night.

The Federal Reserve will meet tomorrow and Wednesday to discuss interest rate policy. While policymakers won’t cut rates, they will release new “dot plot” forecasts suggesting how many cuts they are leaning toward later in 2025 and early 2026. Markets are currently pricing in three 25 basis point reductions over the next year, most likely starting in September.

Finally, Meta Platforms Inc. (META) is REALLY going all-in on AI. Days after revealing plans to assemble a “superintelligence” group of Artificial Intelligence researchers, the parent company of Facebook and Instagram shelled out $14.3 billion to buy a 49% stake in Scale AI. Meta uses AI in ad targeting, creation, and engagement, among other tasks.

S&P 500 5,976.97 (-1.13%) ↓ | VIX 19.77 (-5.04%) ↓ |

Dow Jones Industrial Average 42,197.79 (-1.79%) ↓ | Gold $3,434.20 per ounce (-0.54%) ↓ |

Nasdaq Composite 19,406.83 (-1.3%) ↓ | Oil $71.97 per barrel (-1.38%) ↓ |

Are you sitting on the sidelines waiting for real estate prices to slump further...while missing some of the biggest opportunities in years? In this fireside chat from the MoneyShow Masters Symposium in Miami, real estate mogul Kevin Maloney sits down with Eric Bolling to settle the debate once and for all — and his answer might surprise you.

You'll hear why Kevin believes rising rates actually created sizable opportunities for savvy investors, why he's targeting distressed properties while others wait for the "perfect" moment, and what Florida's infrastructure challenges mean for smart money. Plus, Kevin reveals his contrarian take on market timing, why the multifamily space is "pretty much shut down," and why he pivoted from 70% rentals to 70% condos.

If you're debating whether to buy real estate now or wait for prices to drop — this conversation will give you the clarity you need to make the right decisions.

Starting TOMORROW: Our Mid-Year Portfolio Review Virtual Expo!

Enjoy two full days of interactive briefings on stocks, bonds, commodities, and alternative investments — streamed straight to your smartphone, laptop, or tablet!

Get expert tips and picks for the second half of the year — on AI from Tom Taulli…seasonality from Jeff Hirsch…geopolitics from John Rutledge…and fixed income from Nancy Davis!

Register for FREE — then join the experts online starting Tuesday, June 17 at 10:05 am Eastern!

ASML & TSM: Why You Should Focus on Chip Manufacturers

👉️ TICKERS: AMAT, AVGO, KLAC, LRCX, NVDA, TSM, ASML

The market capitalization leaderboard for semiconductors continues to highlight the divergence between IP ownership and physical production. US firms dominate the top rankings — Nvidia Corp. (NVDA) at $2.476 trillion, Broadcom Inc. (AVGO) at $804 billion — but that masks how irreplaceable the manufacturing layer has become in a geopolitically fractured world, advises George Gilder, chief analyst at Gilder’s Technology Report.

FMKT: An ETF Designed to Profit from Deregulation

👉️ TICKER: FMKT

For years, regulation has acted as a drag on the economy. While it’s designed to protect consumers, stabilize markets, and reduce systemic risk, it can also slow innovation, make it more difficult to bring new products to market, and result in millions of dollars of extra expense. That’s why, with three other partners, I’ve brought The Free Markets ETF (FMKT) to market, says Michael Gayed, editor of The Lead-Lag Report.