- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 06/11/25

Top Pros' Top Picks 06/11/25

Mike Larson | Editor-in-Chief

Markets were cheered by two developments overnight and this morning, with equities and Treasuries rebounding from earlier losses. Gold is rising along with crude oil, while the dollar is dipping.

Yes, the inflation data IS getting better – and that’s a plus! The Consumer Price Index (CPI) rose just 0.1% in May, below the average forecast for a gain of 0.2% The “core” index that strips out food and energy also rose 0.1%, compared with expectations for a 0.3% rise.

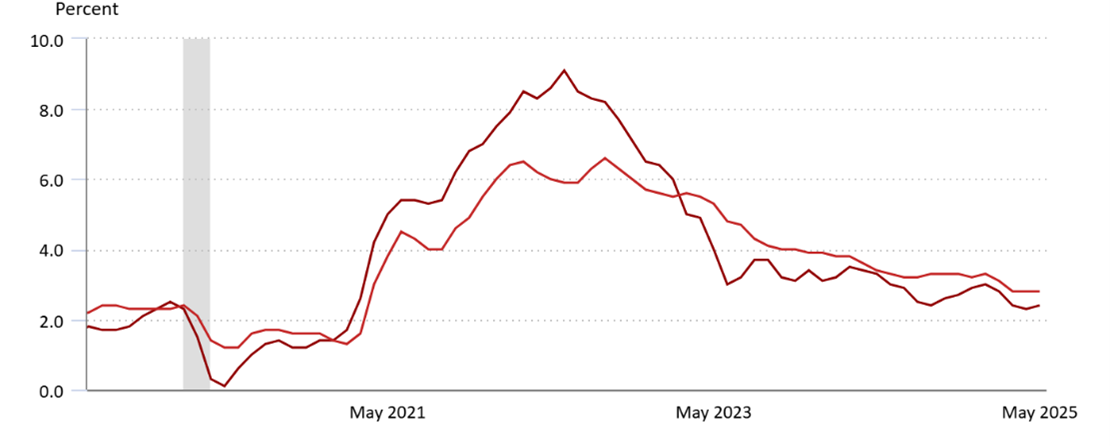

Headline, Core Inflation (YOY % Change)

Source: Bureau of Labor Statistics

From a year ago, inflation is running at 2.4% on the headline and 2.8% on the core. While many experts have worried that higher tariffs would feed through to broad goods prices, this data suggests we’re not seeing it yet. The Federal Reserve will be pleased, even as we still aren’t likely to see any rate cuts at the meeting that concludes next Wednesday. Ditto for the one after it that wraps on July 30...though September is in play.

Meanwhile, the latest round of US-China trade talks in London are over...and both sides have shared upbeat comments afterward. It looks like we’ll see an easing of slow-walked or newly restricted exports (rare earths in China’s case, tech gear in the US’s case).

President Trump and President Xi Jinping will have to review and sign off on what negotiators agreed to. Plus, based on what Trump shared in a social media post this morning, it looks like we’re mostly back to where we were after a previous round of talks in Geneva a month ago. But that appears to be good enough for markets.

S&P 500 6,038.81 (+0.55%) ↑ | VIX 17.06 (+0.65%) ↑ |

Dow Jones Industrial Average 42,866.87 (+0.25%) ↑ | Gold $3,353.80 per ounce (+0.31%) ↑ |

Nasdaq Composite 19,714.99 (+0.63%) ↑ | Oil $66.14 per barrel (+1.79%) ↑ |

Are you still scared from the April market crash – when you should be positioning for the next bull run? In this presentation from the MoneyShow Masters Symposium in Miami last month, Fundstrat's Head of Research Tom Lee offers insights into market performance and potential stocks to consider moving forward.

You'll hear why waterfall declines historically create V-shaped recoveries, how the VIX surge forced liquidations that created opportunities, why US markets are showing exceptional strength versus international peers, and what Tom’s "Granny Shots" strategy reveals about beaten-down value plays. Plus, Tom breaks down why 2026 could be explosive for small caps, financials, and industrials…and why timing the market is mathematically impossible.

AAPL: Investors Asking "Is THAT It?" After WWDC Event

👉️ TICKERS: SPX, AAPL

The S&P 500 Index (^SPX) just closed over 6,000 again, on its way toward retaking highs set in February. Meanwhile, Apple Inc. (AAPL) shares fell Monday, and sentiment climbed, as investors asked the obvious: “Where is the smart Siri AI assistant?” notes Tom Bruni, editor-in-chief of The Daily Rip by Stocktwits.

Uranium Stocks: Powering Ahead Thanks to Global Hunt for Energy Security

👉️ TICKER: URA

Energy security is at the top of the list of global worries – and uranium is becoming the number one solution around the world. Uranium shares are rallying in response, write Mary Anne and Pamela Aden, editors of The Aden Forecast.

🏦 The Fed has held rates steady all year in part to insulate against a trade war. But tariffs aren’t the only inflationary pressure at play. (Opening Bell Daily)

📈 ETF adoption has exploded. There were $426 billion worth of net inflows pumped into ETFs in the fourth quarter of 2024 with private credit, CLOs, cryptocurrency-based vehicles all growing quickly. ETF Upside is your key to understanding this fast-moving ecosystem. Built for advisors and capital advisors, it's quickly become a must-read. Sign up for free here. (Sponsored)