- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 06/10/25

Top Pros' Top Picks 06/10/25

Mike Larson | Editor-in-Chief

Stocks were mixed after a late-day fade yesterday...and they’re mixed in early trading today. Crude oil is up modestly, while gold, silver, and the dollar are flat. Bitcoin is flirting with $110,000 again.

Turns out “Liquid Glass” isn’t revolutionary enough to excite investors. Or at least, that’s the conclusion you can draw from trading in Apple Inc. (AAPL) yesterday after the firm revealed the new device interface. Apple’s annual Worldwide Developers Conference, or WWDC, has long been one of the tech hardware and software company’s signature events. But Apple didn’t have any truly big news in store.

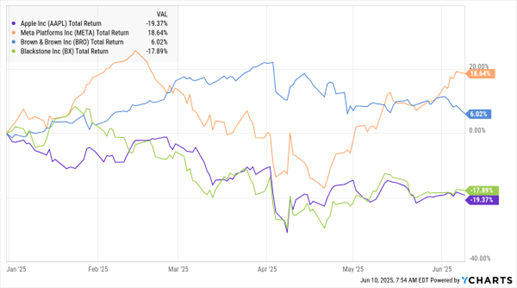

AAPL, META, BRO, BX (YTD % Change)

The firm is reportedly planning to share more innovative "Apple Intelligence" AI developments next year. Meanwhile, its shares slipped 1.2% yesterday – and they’re down about 19% year-to-date. Ironically, Bloomberg just reported that Meta Platforms Inc. (META) CEO Mark Zuckerberg is frustrated with the pace of AI research at his company. His response? To assemble a “superintelligence” group of leading AI researchers and experts to accelerate META’s efforts.

We have another deal in the insurance industry. Broker Brown & Brown Inc. (BRO) will fork over $9.8 billion for Accession Risk Management, adding a firm that owns the specialty brokerage firm Risk Strategies. Leading players have been bulking up to gain economies of scale in a fragmented space.

Could the next big investment frontier be...Europe? That’s what Blackstone Inc. (BX) CEO Steve Schwarzman just seemed to imply when he announced plans to invest $500 billion in the region over the next 10 years. Europe has long been as a region hamstrung by government regulation and slow growth. But Schwarzman said they are “starting to change their approach here, which we think will result in higher growth rates.”

S&P 500 6,005.88 (+0.09%) ↑ | VIX 17.21 (+0.29%) ↑ |

Dow Jones Industrial Average 42,761.76 (-0.0%) ↓ | Gold $3,858 per ounce (+0.09%) ↑ |

Nasdaq Composite 19,591.24 (+0.31%) ↑ | Oil $65.71 per barrel (+0.64%) ↑ |

It's a quiet morning so far in FX/metals. But it has been a heck of a year for the dollar, gold, and silver! Find out what's driving the action — and how you can capitalize as an investor — in this excerpt from our latest MoneyShow MoneyMasters Podcast featuring Huzefa Hamid of DailyForex.com.

NEXT Month: Your Chance to Learn from the Experts in Las Vegas!

The 2025 MoneyShow Masters Symposium Las Vegas is your ticket to a world of education, entertainment, and networking — at our ALL-NEW venue, Caesars Palace July 15-17.

Get actionable investing and trading guidance and recommendations from DOZENS of the nation’s leading financial experts! Headline speakers include Anas Alhajji, John Carter, Tom DeMark, Carley Garner, Paul Hickey, Stephanie Link, Mark Mahaney, and more.

Dive deep into stock, option, and commodity market trends courtesy of our biggest lineup of MoneyMasters Courses EVER. Plus, learn about unique investment opportunities in oil and gas, tech, financials, and other sectors from our curated list of event sponsors.

SPX: If We Recapture Old Highs, What Next?

👉️ TICKER: SPX

As of June 6, the S&P 500 Index (^SPX) was a shade more than 2% away from its Feb. 19 all-time high. Closing above that prior record would complete the round-trip for the most recent 19% decline and mark the 25th correction (decline of 10% to 19.9%) since WWII, writes Sam Stovall, chief investment strategist at CFRA Research.

BEP: A Solid Play for Profiting from Utility Sector M&A

👉️ TICKERS: BEPC, BEP

There have been literally thousands of utility mergers in the 125 years or so since electricity, heat, communications, and water became essential services. The key motivation for 2025 utility M&A is a quest for scale. The best way to bet on it is to build positions in the strongest companies that are on track to grow with or without a deal – like Brookfield Renewable Partners LP (BEP), explains Roger Conrad, editor of Conrad’s Utility Investor.