- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 06/06/25

Top Pros' Top Picks 06/06/25

Mike Larson | Editor-in-Chief

Markets are breathing easier after encouraging jobs data hit the tape this morning. Stocks are rising after giving up ground on Thursday. Treasuries are slipping and the dollar is climbing, while precious metals and crude oil are mostly flat.

Expectations had been lightening up this week after ADP employment data came in weak on Wednesday AND the Challenger, Gray & Christmas data released yesterday showed layoff announcements surged 47% year-over-year in May. But Labor Department figures showed the economy created 139,000 jobs last month, slightly ahead of forecasts. The unemployment rate held steady at 4.2%, as expected, while average hourly earnings grew a better-than-forecast 0.4%.

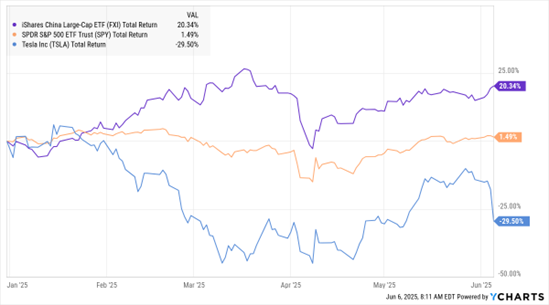

FXI, SPY, TSLA (YTD % Change)

In other news, an extraordinary dust up between Tesla Inc. (TSLA) CEO Elon Musk and President Trump yesterday sent TSLA shares careening 14% lower. The two argued over tax cut legislation, Tesla’s government contracts, and more on social media and in the press. That fueled Tesla’s second-worst one-day drop since 2020, a move that lopped $150 billion off the stock’s market capitalization. TSLA has now lost more than 29% year-to-date, though it's bouncing a bit today after tensions cooled overnight.

Finally, Trump and Chinese president Xi Jinping held a long-rumored phone call on Thursday. Trump said the call resulted in progress on the rare-earth export front, while Chinese officials believe they got relief from a threatened ban on Chinese students attending US universities.

S&P 500 5,939.30 (-0.53%) ↓ | VIX 17.24 (-6.71%) ↓ |

Dow Jones Industrial Average 42,319.74 (-0.25%) ↓ | Gold $3,378.30 per ounce (+0.09%) ↑ |

Nasdaq Composite 19,298.45 (-0.83%) ↓ | Oil $63.53 per barrel (+0.25%) ↑ |

A falling dollar and rising gold are offering up a one-two punch of profit opportunities for investors. But how should you play the moves? What else is cooking in forex and precious metals markets? This week’s MoneyShow MoneyMasters Podcast features a double-dose of expert guidance — from DailyForex.com senior analyst Huzefa Hamid and Luma Financial president Albert Lu. Check it out HERE.

BYD & Buffett: Why Sometimes Doing NOTHING is the Better Choice

👉️ TICKERS: BRK.A, COST, BYDDY

I’ve recently written about Warren Buffett and his sale of Costco Wholesale Corp. (COST) – and how it lost him $1.3 billion in foregone profits. That was far from Buffett’s only flub. Let’s talk about BYD Co. (BYDDY) and why “doing nothing” might have been the better choice, writes Nicholas Vardy, editor of The Global Guru.

MIOFX: A Fund for Profiting from Foreign Market Strength

👉️ TICKER: MIOFX

International stocks have shown on-again, off-again performance over the last 10 years or so. So far in 2025, the pattern is continuing, and it is an ON year. I like the Marsico International Opportunities Fund (MIOFX), highlights Brian Kelly, editor of MoneyLetter.