- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 06/04/25

Top Pros' Top Picks 06/04/25

Mike Larson | Editor-in-Chief

Markets are relatively quiet so far, with stocks, gold, and crude oil all mostly flat. Treasuries are rallying modestly, though, while the dollar is dipping.

We have a switcheroo in major markets. Led by strong performance in non-US equities, the MSCI All-Country World Index just tagged 888.24 – topping its previous February peak of 887.72. The Stoxx Europe 600 Index is beating the S&P 500 by the widest margin on record. In the Americas, all major indices are outperforming the S&P 500 handily, with benchmark indices in Canada up 6.8%, Brazil up 14.3%, and Mexico up 16.4%.

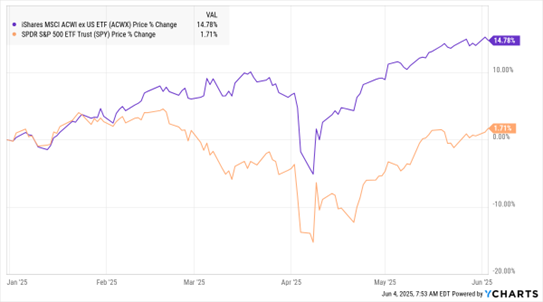

ACWX vs. SPY (YTD % Change)

This chart shows the performance of the iShares MSCI ACWI ex US ETF (ACWX) compared to the SPDR S&P 500 ETF Trust (SPY). The former holds more than 1,700 non-US stocks, with the highest weighting in names like Taiwan Semiconductor Manufacturing (TSM), Tencent Holdings Ltd. (TCEHY), and SAP SE (SAP). As you can see, ACWX has gained just under 15% so far in 2025, compared with only 1.7% for the SPY.

This is a big week for job market data – and today’s ADP number didn’t exactly excite Wall Street. The private payroll company said the US economy added just 37,000 jobs in May. That was down from 60,000 a month prior and FAR below the average forecast of 115,000. Official Labor Department numbers are due out Friday morning.

In other news, US-China trade disagreements keep festering. President Trump called Chinese President Xi Jinping “extremely hard to make a deal with” in a social media post overnight. Hoped-for talks between the two leaders still haven’t happened.

Meanwhile, China’s crackdown on exports of rare-earth metals is threatening manufacturers here in the US. Auto companies are particularly vulnerable, especially those who are titling more toward Electric Vehicle (EV) production. Those vehicles need rare-earth magnets to function and sourcing them from China has become much more difficult..

S&P 500 5,970.37 (+0.58%) ↑ | VIX 18.62 (-0.5%) ↓ |

Dow Jones Industrial Average 42,519.64 (+0.51%) ↑ | Gold $1,850.00 per ounce (+1.2%) ↑ |

Nasdaq Composite 19,398.96 (+0.81%) ↑ | Oil $75.00 per barrel (-0.5%) ↓ |

In light of recent foreign market outperformance, Amber Kanwar’s April appearance on the MoneyShow MoneyMasters Podcast is worth watching. She talked about the US-Canada tariff fight, the relative merits of investing in US vs. Canadian stocks, and much more. Check out what the host of the In the Money with Amber Kanwar podcast had to say HERE!

Coming in July: The 2025 MoneyShow Masters Symposium Las Vegas!

Uncover new stock, bond, commodity, and alternative investment plays to help power your portfolio ahead in the rest of 2025 — and beyond!

Learn new strategies and investing secrets from the nation’s leading money experts. Headlining speakers include Larry McDonald of The Bear Traps Report, John Carter of Simpler Trading, Tom DeMark of DeMARK Analytics, Stephanie Link of Hightower Advisors, Anas Alhajji of Energy Outlook Advisors, and DOZENS more!

Network and swap investment ideas with hundreds of fellow high-net-worth investors and traders at our glamorous, ALL-NEW venue, Caesars Palace!

The next leg of your investing journey begins July 15-17 in Las Vegas. We can’t wait to welcome you there.

Consumers: What Confidence and Costco Tell Us About the Spending Outlook

👉️ TICKER: COST

The good news recently was that the Conference Board announced its consumer confidence index surged in May to 98, up from 85.7 in April. Especially encouraging is that the expectations component soared to 72.8 in May, up from 55.4 in April, notes Louis Navellier, founder and chairman of Navellier & Associates.

ORCL: A Booming Data Center Play Amid Broader Market Uncertainty

👉️ TICKER: ORCL

The market has leveled off since the huge recovery from the tariff Armageddon fears. Now, who knows? Meanwhile, Oracle Corp. (ORCL) is a technology stalwart with strong growth catalysts ahead thanks to data centers and AI, writes Tom Hutchinson, editor of Cabot Income Advisor.

🔌 🖥️ Meta goes nuclear to fuel its AI Ambitions. The Facebook parent signed a 20-year deal with Constellation Energy. (Opening Bell Daily)