- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 06/03/25

Top Pros' Top Picks 06/03/25

Mike Larson | Editor-in-Chief

Stocks are treading water this morning after a late-day rally yesterday. Gold and silver are pulling back a bit, while crude oil is rising modestly along with the dollar. Treasuries are flattish.

Investors are warily eyeing a raft of economic reports out this week. Yesterday’s ISM manufacturing index came in a bit light, and the services-sector counterpart report looms tomorrow. We also get fresh monthly payrolls data on Friday; Job growth is expected to decelerate to 130,000 in May from 177,000 in April. Ahead of those figures, the Organization for Economic Cooperation and Development (OECD) cut its global GDP growth forecasts today – a wet blanket weighing on markets.

The chorus of financial heavy hitters warning about the US government’s finances and debt markets is growing louder, too. JP Morgan Chase & Co. (JPM) CEO Jamie Dimon was the latest to caution about a “crack in the bond market.” Worry about rising deficits and debt is a key reason the Trump Administration’s tax and spending bill is struggling in Congress.

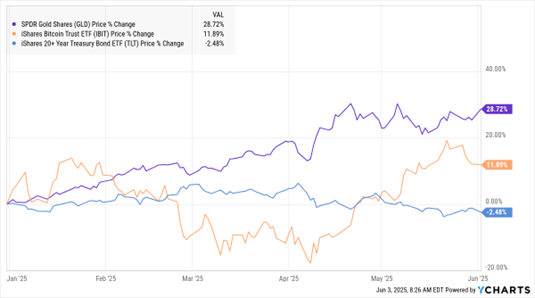

GLD, IBIT, TLT (YTD % Change)

Treasuries aren’t tanking too much…yet. The yield on the 30-Year Treasury Bond is only hovering around 5%, while the iShares 20+ Year Treasury Bond ETF (TLT) has lost just 2.4% this year. But we HAVE seen stellar performance among alternative stores of value like gold and Bitcoin, indicating capital rotation is underway. The iShares Bitcoin Trust ETF (IBIT) has gained more than 11% year-to-date, while the SPDR Gold Shares (GLD) has surged just over 28%.

Job cuts are another development worth noting. Microsoft Corp. (MSFT) reportedly let a few hundred more workers go yesterday after a 6,000-employee purge announced last month. Leading technology firms are paring back in some places to free up more money to invest in Artificial Intelligence (AI) initiatives. Meanwhile, global auto giant Volkswagen AG (VWAGY) said more than 20,000 German workers will take early retirement deals to pare that company’s workforce in the next few years.

S&P 500 5,935.94 (+0.41%) ↑ | VIX 18.47 (+0.6%) ↑ |

Dow Jones Industrial Average 42,305.48 (+0.08%) ↑ | Gold $3,386 per ounce (-0.33%) ↓ |

Nasdaq Composite 19,242.61 (+0.67%) ↑ | Oil $63.25 per barrel (+1.17%) ↑ |

Sam Stovall is Chief Investment Strategist at CFRA Research. In this insightful briefing from our MoneyShow Virtual Expo in late May, he lays out the respective cases for a recession and recovery. He then explains which scenario he expects to play out — and provides coping strategies investors can use to maximize their returns and minimize their risks.

SPX: Yes, We Could Finish 2025 at 6,600 Given Earnings, AI Growth

👉️ TICKER: SPX

Roughly 98% of S&P 500 companies have reported and of that total, 64% have reported positive revenue surprises and 78% have reported positive EPS surprises. I am starting to wrap my mind around the S&P 500 finishing the year at 6,500, perhaps even 6,600, advises Keith Fitz-Gerald, editor of 5 With Fitz.

Earnings, Jobs Data to Drive Next Market Moves

👉️ TICKERS: CRWD, FIVE, LULU, SPY

Markets entered the new week with a steady tone as investors shifted their attention from earnings season toward key economic updates. While most first quarter results are behind us, a few notable companies are still set to report and could offer valuable insight into the health of the consumer, notes Gav Blaxberg, CEO of Wolf Financial.