- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 06/02/25

Top Pros' Top Picks 06/02/25

Mike Larson | Editor-in-Chief

Stocks are selling off in the early going, while “safe haven” assets like gold and silver are spiking (along with crude oil). Treasuries and the dollar are down.

Hopes for détente in the US-China trade war are fading after tit-for-tat charges of violations. President Trump said late last week that China was backtracking on pledges related to rare-earth metals exports. Then today, China’s Ministry of Commerce said the US was illegitimately controlling exports of Artificial Intelligence (AI) chips and revoking Chinese student visas. That jeopardizes the preliminary agreements reached in Geneva talks last month.

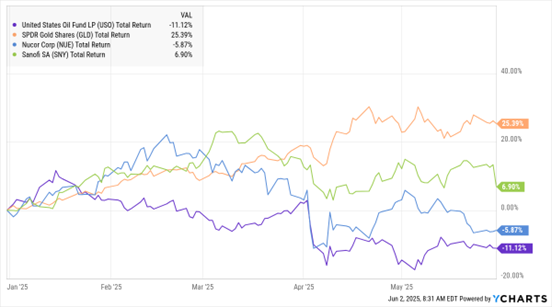

USO, GLD, NUE, SNY (YTD % Change)

Ukraine launched an audacious drone attack in Russia over the weekend. Five separate airfields deep within Russia were struck with a force of 117 drones, and dozens of Russian long-range bombers and surveillance airplanes were reportedly damaged. Ukrainian and Russian negotiators are meeting in Istanbul for peace talks and the strike was likely designed to give Ukraine some additional leverage.

The prices of crude oil, gold, and silver all rose in the wake of the attacks as they rekindled geopolitical fears in markets. That said, OPEC+ just agreed to raise output by 411,000 barrels per day in July. Concerns about more barrels returning to the market over time are keeping pressure on crude, which is still down about 11% year-to-date.

Merger Monday might be a hackneyed term, but I’m going with it anyway. Sanofi SA (SNY) announced it’ll purchase Blueprint Medicines Corp. (BPMC) for $9.1 billion. The French-US pharmaceutical deal was Sanofi’s largest since 2018, and it adds existing and potential immunology treatments to Sanofi’s arsenal.

Finally, shares of US steel companies are surging after the president vowed to double steel import tariffs to 50% from 25%. Trump’s plan will allow US producers to hike prices, making more money on their metals output. Cleveland-Cliffs Inc. (CLF) and Nucor Corp. (NUE) were among the beneficiaries.

S&P 500 5,911.69 (-0.01%) ↓ | VIX 19.74 (+6.3%) ↑ |

Dow Jones Industrial Average 42,270.07 (+0.13%) ↑ | Gold $3,388.10 per ounce (+2.19%) ↑ |

Nasdaq Composite 19,113.77 (-0.32%) ↓ | Oil $63.71 per barrel (+4.8%) ↑ |

If you’re looking to maximize your returns as a trader, you should focus on a few set routines in the morning. That’s the advice shared by expert trader Linda Raschke in this “from the vault” video interview here at MoneyShow. As she says: “The more you can do something consistently the same way, the easier it is for you to slip into that zone.”

Join 100+ Top Money Experts for Our Signature 2025 Las Vegas Symposium!

Uncover new ways to profit in red-hot stocks, precious metals, and cryptocurrencies — and take home dozens of picks you can put to work in your portfolio right away

Get insightful guidance and actionable recommendations for your bonds, options, commodities, real estate, and alternative investments. Plus, network and swap investment ideas with the experts and fellow attendees throughout your time in Vegas

Discover how to allocate your portfolio assets now — with help from the nation’s leading investing and trading authorities! Headlining speakers include Larry McDonald, Stephen Moore, Carolyn Boroden, John Carter, Paul Hickey, and Heather Zumarraga

You’ll also get to take advantage of the broadest lineup of MoneyMasters Courses EVER. AND you’ll enjoy the dining, entertainment, shopping, and more available at our ALL-NEW venue for 2025 — Caesars Palace!

As Tariff Saga Unfolds, Where Will Bond Yields Head?

👉️ TICKERS: SPY, TLT, IEF

In isolation, you’d think that a sudden halt for President Trump’s tariffs would be warmly welcomed by the market. US stock prices did move higher right out of the gate...but then pulled back to relatively unchanged. The initial reaction of the 10-year Treasury yield also posed an interesting thought experiment, writes Michael Gayed, editor of The Lead-Lag Report.

CTRI: A Utility Play That Just Landed Large, New Contracts

👉️ TICKER: CTRI

Last Tuesday, Centuri Holdings Inc. (CTRI) announced $350M in new customer awards. The awards span the US and include work supporting electric and gas infrastructure modernization, water relocation, utility distribution, and renewables, notes Clif Droke, editor of Cabot Turnaround Letter.