- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 05/23/25

Top Pros' Top Picks 05/23/25

Mike Larson | Editor-in-Chief

After giving up most of their gains yesterday, stocks are slumping today amid renewed tariff threats. Crude oil is falling along with the dollar, while gold is rallying. Treasuries – for a change – are higher in price.

Just when you thought the tariff turmoil had settled down...President Trump decided to mix things up. Specifically, this morning he threatened to slap 50% tariffs on goods from the European Union (EU), saying policymakers there aren’t negotiating in good faith. He also pledged to hit Apple Inc. (AAPL) with a 25% tariff on the firm’s products if it continued to produce iPhones for US purchase in China or India versus the US. Markets tanked in response.

Meanwhile, the global bond market is getting more attention these days – and for good reason. Faced with a glut of bond issuance from the US and other debt-burdened nations, investors are pushing back. They’re demanding higher yields to buy bonds at auction and in the secondary markets. That’s threatening to derail tax, spending, and borrowing plans that governments would otherwise like to pursue.

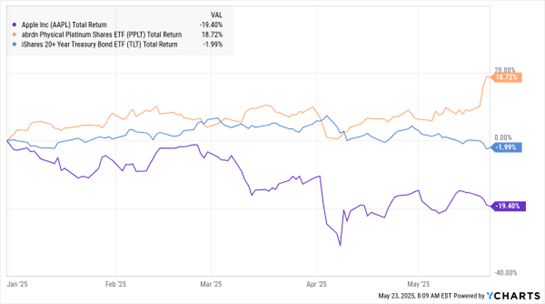

The iShares 20+ Year Treasury ETF (TLT) just slipped into the red again, with a loss of about 2% year-to-date. I highly recommend checking out our latest MoneyShow MoneyMasters Podcast episode featuring Crossmark Global’s Victoria Fernandez for critical intelligence on why this is happening – and what’s coming next.

AAPL, PPLT, TLT (YTD % Change)

Don’t look now – but ANOTHER precious metal (besides gold) is getting in on the bullish action. This time, it’s platinum! The metal just hit $1,097 an ounce in the spot market, up more than 10% on the week to a two-year high. Not only is platinum supply failing to keep up with demand, but some believe demand will rise as jewelry buyers shift to platinum products from gold ones given how expensive gold has become. The abrdn Physical Platinum Shares ETF (PPLT) is now up 18.7% year-to-date.

Finally, if you’re planning on traveling for the Memorial Day weekend, you might want to shut down your laptop now and hit the road. The American Automobile Association (AAA) predicts travel volume will hit an all-time record for the holiday, with more than 45 million Americans traveling at least 50 miles from home. That would represent a 1.4 million-traveller rise from last year – and top the record 44 million that hit the road, train station, or airport in 2005.

Speaking of the holiday, US markets will be closed for Memorial Day on Monday – so there will be no Top Pros’ Top Picks newsletter on May 26. We will resume publication Tuesday, May 27. Happy Memorial Day!

S&P 500 5,842.01 (-0.04%) ↓ | VIX 20.75 (+2.32%) ↑ |

Dow Jones Industrial Average 41,859.09 (-0.0%) ↓ | Gold $3,328 per ounce (+1%) ↑ |

Nasdaq Composite 18,925.73 (+0.28%) ↑ | Oil $61.31 per barrel (+0.18%) ↑ |

This pre-holiday week featured plenty of fireworks in the BOND market. From a lousy 20-year Treasury Bond auction to rising investor worries about government debt and deficits, the end result was higher interest rates globally. What does it all mean for you as an investor — and what subsectors of the market should you keep a close eye on? Here’s a special MoneyShow video update with my take.

Interest Rates: Budget Deficit, Borrowing Woes Worrying Bond Investors

👉️ TICKERS: ^TNX, ^TYX, TLT, IEF

Stocks have been selling off amid the passage of President Trump’s “big, beautiful” budget bill. Why? It’s doing little to quell anxieties in the bond market. For years people have said government borrowing and deficits are on an unsustainable path. But it appears 2025 is the year that is coming home to roost, observes Amber Kanwar, host of the In the Money with Amber Kanwar podcast.

CCL: An Undervalued Consumer Play You Shouldn't Pass Up

👉️ TICKERS: DKS, XRT, CCL

The SPDR Retail ETF (XRT) is down 3.8% year-to-date, and consumer discretionary as a whole has been the worst performing of the 11 major S&P sectors. But most of the hard data still points to a healthy US economy. I like Carnival Corp. (CCL), writes Chris Preston, chief analyst at Cabot Value Investor.