- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros' Top Picks 05/19/25

Top Pros' Top Picks 05/19/25

Mike Larson | Editor-in-Chief

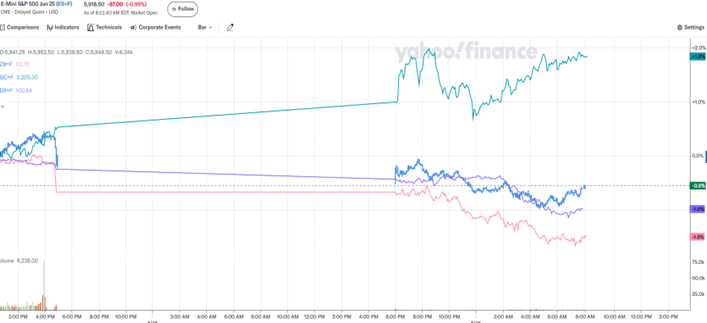

US stocks. US bonds. The US dollar. They’re all dropping in the wake of a key credit rating move late on Friday. Gold and silver are jumping, though. Crude oil is easing back.

Almost a decade-and-a-half after the US lost its FIRST gold-standard credit rating, it lost its last on Friday. Moody’s Ratings downgraded the US to “Aa1” from “Aaa,” several years after S&P Global Ratings (2011) took that step -- and a couple after Fitch Ratings (2023) did the same.

S&P 500 E-Mini, Long Bond, Dollar Index,

Gold Futures (1-Day % Change)

Source: Yahoo Finance

Just like the other agencies, Moody’s cited the US’ growing debt load and ballooning budget deficits. It also highlighted the unwillingness of both Democratic and Republican administrations to take concrete steps to change the nation’s financial trajectory. In its words: “While we recognize the US’ significant economic and financial strengths, we believe these no longer fully counterbalance the decline in fiscal metrics.” The US has $29 trillion in federal debt, and interest costs alone now consume $1 of every $7 the country spends.

The downgrade brought back the “Sell America” trade, at least overnight on Sunday and this morning. But the question is whether the snap reaction will persist over time. The Great Financial Crisis sullied the reputation of the ratings agencies, in large part because they gave top-notch ratings to hundreds of billions of dollars of mortgage securities that subsequently collapsed in value. Many on Wall Street view them as consistently a day late and a dollar short.

Speaking of the US’ balance sheet health, Republicans in the House of Representatives made progress on advancing President Trump’s tax-and-spending bill over the weekend. The only problem? Most outside analysts (including the Committee for a Responsible Federal Budget) say it will BOOST deficits by almost $3 trillion over the next decade, rather than reduce them. Negotiations on the legislation will continue this week.

On the deal front, Advanced Micro Devices Inc. (AMD) said it would sell a data center infrastructure business to Sanmina Corp. (SANM) for $3 billion. AMD picked up that division when it acquired ZT Systems for $4.9 billion earlier this year. The company previously said it would unload the infra unit at some point to focus on the rest of the former ZT’s purchased businesses.

S&P 500 5,958.38 (+0.7%) ↑ | VIX 19.55 (+13.2%) ↑ |

Dow Jones Industrial Average 42,654.74 (+0.78%) ↑ | Gold $3,249.60 per ounce (+1.96%) ↑ |

Nasdaq Composite 19,211.10 (+0.52%) ↑ | Oil $61.98 per barrel (-0.82%) ↓ |

Are tech stocks (still) poised for significant growth? Or are questions about AI demand growth and the rise in global tariffs going to derail “Big Tech?” I spoke with Brian Belski of BMO Capital Markets and Dan Ives of Wedbush Securities to get answers at the MoneyShow Masters Symposium Miami last week. Check out our interview HERE!