- MoneyShow's Top Pros' Top Picks

- Posts

- Top Pros Top Picks 05/07/25

Top Pros Top Picks 05/07/25

Mike Larson | Editor-in-Chief

Stocks are bouncing on news of trade talks, while gold and silver are easing back. The dollar is up modestly along with crude oil, while Treasuries are flattish.

The US and China are officially TALKING! US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer will join Chinese Vice Premier He Lifeng in Switzerland this weekend for trade-focused negotiations. While President Trump has previously indicated talks were going on behind the scenes, Chinese officials denied them – so official acknowledgment from BOTH sides equals progress.

Ahead of the meeting, China’s central bank cut interest rates and reduced the amount of reserves banks have to keep on hand. The former move will make it cheaper to borrow, while the latter move will make more money available to lend.

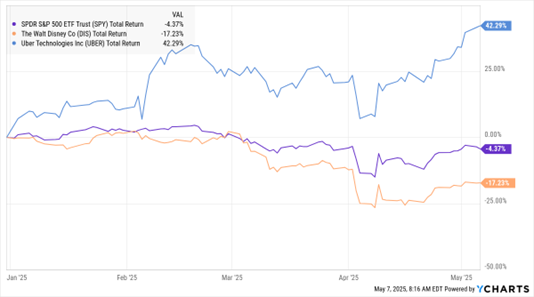

SPY, DIS, UBER (YTD % Change)

Meanwhile, the Federal Reserve will conclude its latest two-day policy meeting today. Virtually no one expects Chairman Jay Powell and company to cut rates from the current range of 4.25% to 4.5%. But markets are closely watching for signs of when and how the Fed will react to economic uncertainty and sliding business and consumer confidence. The “hard” data continues to show the economy doing okay, even as “soft” survey-based data has deteriorated notably.

Earnings continue to roll in as well, with Walt Disney Co. (DIS) topping fiscal second-quarter sales and earnings estimates. The theme park, movie, and streaming content provider also boosted its full-year earnings-per-share target to $5.75. That beat the average Wall Street estimate of $5.44, and would mark a 16% jump from 2024. Shares rallied on the news.

Shares of Uber Technologies Inc. (UBER) didn’t fare as well, though. The rideshare and food delivery company reported gross bookings of $42.8 billion in Q1, slightly below estimates. While the company forecast solid results for Q2, they weren’t as blow-the-doors-off as Wall Street hoped, sending UBER down in early trading.

S&P 500 5,606.91 (-0.77%) ↓ | VIX 24.50 (-1.05%) ↓ |

Dow Jones Industrial Average 40,829 (-0.95%) ↓ | Gold $3,400.80 per ounce (-0.64%) ↓ |

Nasdaq Composite 17,689.66 (-0.87%) ↓ | Oil $59.59 per barrel (+0.85%) ↑ |

Is the US economy heading into stagflation — or a new boom? At the 2025 MoneyShow Masters Symposium Dallas, Eric Wallerstein, chief market strategist at Yardeni Research, delivered his final keynote before joining the White House Council of Economic Advisors. In his sharp and data-heavy session, Eric dove into rising recession risks, tariff impacts, and the surprising strength of U.S. productivity.

Amid Flood of Tariff News, Keep THIS Investing Tenet in Mind

👉️ TICKER: SPY

The word “tariff” appeared 22 times on Yahoo! Finance’s home page recently. That’s a lot of tariff analysis. But all of this misses the core of what investing is, suggests Ben Reynolds, editor of Sure Dividend.

CHY: A High-Yield Fund Poised to Benefit from Ongoing US Growth

👉️ TICKERS: HYG, SPX, CHY

Global equity markets are rebounding on the bullish hard data and the assumption a stream of trade deals will be announced over the next few weeks. Meanwhile, high-yield market conditions continue to improve. I like the Calamos Convertible and High Income Fund (CHY), advises Bryan Perry, editor of Cash Machine.