- MoneyShow's Top Pros' Top Picks

- Posts

- TPTP 02/28/25

TPTP 02/28/25

Mike Larson | Editor-in-Chief

Stocks have had a rough week, with the technology sector getting hit particularly hard. But equities are trying to stabilize so far on Friday. Gold, silver, and crude oil are lower, while Treasuries and the dollar are mostly flat.

“Trump Trades” are in trouble. Many of the stocks, sectors, and asset classes that rallied into and after the election are reversing...in some cases, strongly. As the Wall Street Journal notes here, foreign stocks in several countries targeted with tariffs are outperforming the US S&P 500. Yields are slipping so far in 2025, while the US dollar is cooling after a late-2024 run.

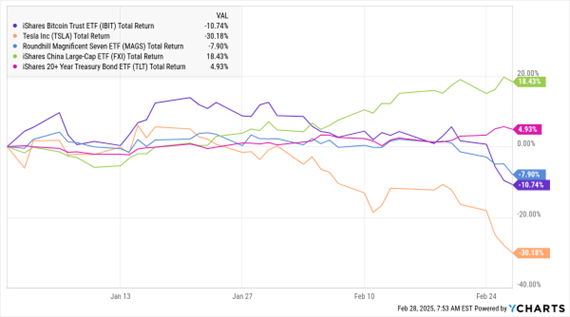

IBIT, TSLA, MAGS, FXI, TLT (YTD % Change)

Plus, shares of Elon Musk-led Tesla Inc. (TSLA) are plunging. Bitcoin and other cryptocurrencies are sinking. And big-cap technology names are struggling. The chart here shows the year-to-date performance of the iShares Bitcoin Trust ETF (IBIT), TSLA, the Roundhill Magnificent Seven ETF (MAGS), the China Large-Cap ETF (FXI) and the iShares 20+ Year Treasury Bond ETF (TLT). The first three are all down notably, while the latter two are up.

TSLA had surged partly on the assumption Musk’s close alliance with President Trump would help boost profits at his companies. Cryptos rocketed on hopes Trump’s lighter regulatory touch would lead to a business boom. Big-cap tech had thrived on hopes for more M&A due to lighter regulation, plus a ramp up in the Artificial Intelligence (AI) spending boom. Time will tell if the initial rallies – or the subsequent declines – turn out to be “right” in the longer term.

Meanwhile, China vowed it would fight an additional 10% tariff that Trump promised with “all necessary measures.” The president had already implemented a 10% duty on Chinese imports, and the new round is slated to take effect March 4. That said, financial and military officials in Beijing and Washington continue to hold talks aimed at keeping things from spiraling out of control – even as Trump and Chinese President Xi Jinping haven’t yet spoken.

S&P 500 5,861.57 (-1.59%) ↓ | VIX 21.02 (-0.52%) ↓ |

Dow Jones Industrial Average | Gold $2,860.00 per ounce (-1.24%) ↓ |

Nasdaq Composite 198,544.42 (-2.78%) ↓ | Oil $69.57 per barrel (-1.11%) ↓ |

The S&P 500 posted its second consecutive 20%+ annual advance in 2024. Yet since WWII, only 20% of the time did the S&P 500 follow up with a “three-peat.” What’s more, 2024 was the sixth year in the past eight in which the Tech sector rose by 30% or more.

With that in mind, should investors buy last year’s winners or losers? A “Free Lunch” is defined as receiving something for nothing, or with investing, receiving a higher return with lower volatility. In this video, Sam Stovall, Chief Investment Strategist at CFRA Research, discusses whether history advises buying last year’s winners or losers.

MU: New HBM Tech Push Should Boost Sales Growth

👉️ TICKERS: MU, NVDA

Micron Technology Inc. (MU) is bidding for leadership in high-bandwidth memory (HBM) technology with mass production of its 12-stack HBM3e. The chip will position Micron as a critical supplier to Nvidia Corp. (NVDA), and further its ambition to capture a larger share of the lucrative AI-driven memory market, suggests George Gilder, editor of Gilder’s Technology Report.

TCOM: An Example of What to Buy in China (and How!)

👉️ TICKER: TCOM

As we know, Chinese stocks have seen a massive run of epic proportions over the past 30-40 days. The Hang Seng Index has soared almost 3,000 points in a non-stop run that I’ve seen only two-three times over the last four years. One of my most familiar names within my China coverage is Trip.com Group Ltd. (TCOM), writes Larry Cheung, founder of Letters from Larry.

Are you Bullish or Bearish on Stocks? |